How Does Child Support Work in Texas?

Contents

- How Does Child Support Work in Texas?

- Texas Child Support Guidelines

- Cost of Raising a Child

- Determining Child Support

- Role of income in child support calculations

- How do I start the process of child support in Texas?

- Modifying Child Support

- Child Support and Parenting Time

- Texas Child Support and Lower Income

- Health Insurance and Medical Support

- Non-Payment and Legal Consequences

- Appealing Child Support Decisions

- Resources and Support

- FAQs and Common Issues

- What are the rules for child support in Texas?

- What is the minimum child support per child in Texas?

- What is the maximum guideline for child support in Texas?

- What are the child support guidelines for 2025 in Texas?

- What is the average child support payment in Texas?

- What percentage of income does Texas take for child support?

- Is child support required with 50-50 custody in Texas?

- Is child support based on a 40-hour work week in Texas?

- How do I avoid child support in Texas?

- Can a father stop paying child support in Texas?

- What does child support not cover in Texas?

- Does the custodial parent’s income affect child support in Texas?

- Glossary

- Final Word

In Texas, a noncustodial parent is required to provide financial support for their child or children in accordance with the state’s guidelines. The amount of support due depends on the number of children being supported; specifically, one child requires 20% of the noncustodial parent’s net income, two children require 25%, three require 30%, four require 35%, and five or more require 40%.

Even when a noncustodial parent is unable to work, child support payments are still mandatory. As such, if you are a noncustodial parent, familiarize yourself with all regulations surrounding child support, and keep informed in order to ensure they are complying with the guidelines as outlined by the state.

In this post, we will provide a comprehensive overview of the Texas child support guidelines in order to help parents understand their rights, responsibilities, and options. While it serves to provide a basic understanding of these regulations, it is highly recommended that individuals consult a competent family law attorney for more detailed information.

Raising a child is an extraordinary responsibility, and it is of utmost importance that they are provided with the necessary financial and emotional support. In Texas, when it comes to child support, two important terms can often come up. The first is “obligor” which refers to the person responsible for paying the child support and the second is “obligee” which refers to the person who is entitled to receive the payments.

- The obligee is the parent who has primary custody of the child – meaning they incur most of the living expenses and have primary possession of the child.

- The obligor is usually the other parent who does not have primary custody of the child and may or may not have possession and/or access to the child.

Texas Child Support Guidelines

When it comes to calculating how much support a parent should pay, Texas law provides some guidelines. These guidelines are used by courts to figure out an amount that is fair for both parents and is in the best interests of the child. In general, these guidelines will take into account factors like the obligor’s income and the number of children involved.

In the state of Texas, noncustodial parents are legally required to pay a percentage of their net income for child support payments. The guideline amounts are as follows:

- One child – 20% of the net income

- Two children – 25% of the net income

- Three children – 30% of the net income

- Four children – 35% of the net income

- Five or more children – 40% of the net income

These percentages hold regardless of whether or not the parent is employed at the time, making it essential for all noncustodial parents in Texas to keep up-to-date with their court-ordered obligations.

Child support payments typically end when the child turns 18 or graduates from high school (whichever happens later). However, if a court determines that a child is disabled – either physically or mentally – then child support payments can continue indefinitely.

No matter what, all parents are obligated and expected to provide financial support for their children – no matter where they live or how much money they make. Child support helps ensure that all children have a stable and secure life!

Cost of Raising a Child

When navigating a divorce, consider the financial costs of raising kids. According to the Brookings Institution, caring for a child from birth to 17 years old can cost more than $300,000. That amounts to an average of nearly $20,000 annually per child.

For parents, this means accounting for their children’s lifestyle in the divorce process, whether it be swim practice or horseback riding lessons.

When the above graphic got shared, I took a closer look – and it’s no wonder so many conversations have been sparked. Diving into the research, I quickly uncovered some key insights. According to the USDA’s report, families in urban areas are spending 27% more per child than those in rural communities due to higher housing and food costs. And being in a higher-income bracket means parents are expected to spend more than twice as much on each child – even when they don’t need to.

Determining Child Support

Child support calculations in Texas are determined by a set of guidelines designed to ensure fairness and consistency. Understanding how these guidelines work is essential for anyone navigating the complexities of child support in the Lone Star State.

In Texas, child support is primarily determined based on the noncustodial parent’s income and the number of children involved. The guidelines take into account both parent’s income, but the noncustodial parent’s income is the main factor in the calculation.

salary, The Texas Family Code provides a detailed formula for calculating child support. It starts with determining the noncustodial parent’s net income, which includes wages, commissions, bonuses, and other sources of income. Other deductions, such as taxes and healthcare expenses, may be subtracted to arrive at the net income figure.

Once the net income is determined, a percentage is applied based on the number of children. For example, if there is one child, the noncustodial parent may be required to pay 20% of their net income in child support. The percentage increases with each additional child, up to a maximum of 40% for five or more children.

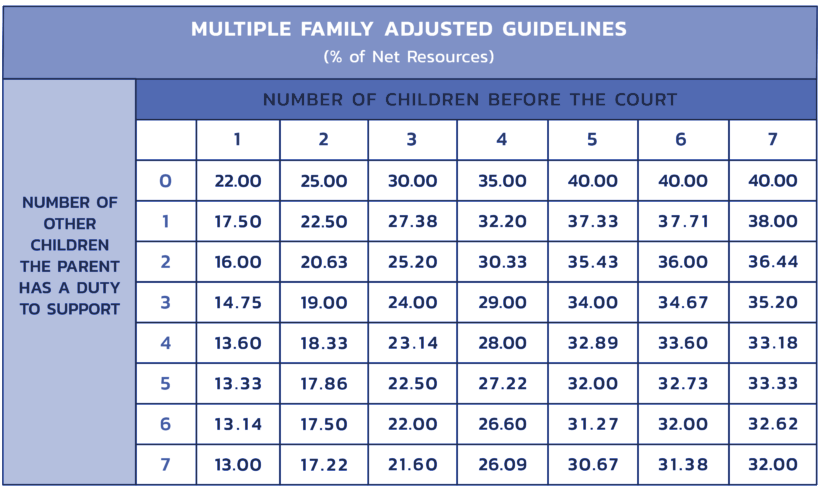

It’s important to note that these percentages are subject to adjustment based on various factors. For instance, if the noncustodial parent has other children for whom they are already providing support, the percentage may be reduced. Additionally, the court may consider factors such as the child’s healthcare and educational needs, travel expenses for visitation, and the custodial parent’s income and ability to support the child.

Role of income in child support calculations

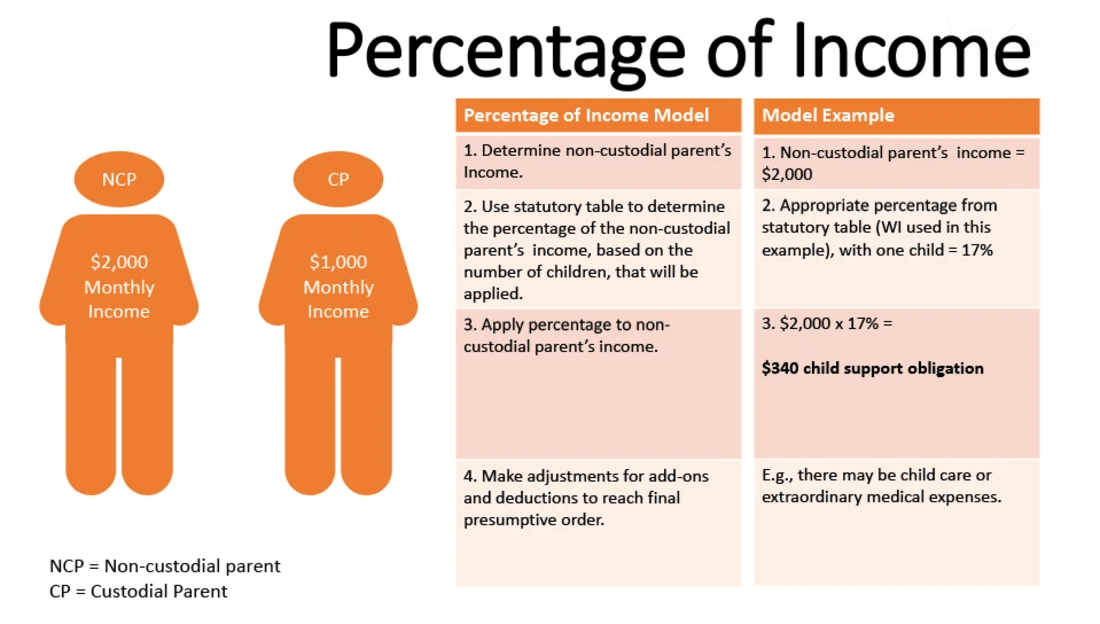

Every state has its own way of calculating child support. The most common models are the Income Shares Model, the Percentage of Income Model, and the Melson Formula.

The Income Shares Model considers both parents’ incomes when making a determination of how much support is due. Forty-one states, Guam, and the Virgin Islands use this model, with the idea that a child should receive the same share of parental income they would have had their parents been living together.

In Texas, the guidelines follow a Percentage of Income Model, where a certain percentage of the noncustodial parent’s income is allocated for child support. The custodial parent’s income is irrelevant. The percentage varies depending on the number of children involved in the case. For example, if there is one child, the noncustodial parent is typically required to pay 20% of their net income as child support.

Net income is an important factor in these calculations. It refers to the income after deducting taxes, social security payments, union dues, and certain medical expenses.

There are also special provisions for considering health care expenses, imputed income, and childcare costs, as well as shared custody, split custody, and extraordinary visitation.

How do I start the process of child support in Texas?

Filing for child support in Texas involves a series of steps. Keep in mind that the process may vary slightly depending on your specific circumstances, but the following general steps will help guide you through the process:

- Gather Necessary Information:

Collect all relevant information about yourself, the child, and the other parent, including full names, addresses, Social Security numbers, birth certificates, and any existing court orders.

- Contact the Texas Attorney General’s Office:

The Texas Attorney General’s Child Support Division oversees child support enforcement in the state. You can contact them by visiting their website or calling the Child Support Division hotline.

- Request an Application:

You can request a child support application from the Texas Attorney General’s office online, by phone, or in person at your local child support office.

- Complete the Application:

Fill out the child support application form provided by the Attorney General’s office. Be thorough and provide accurate information. You may need to include details about your child’s needs and the other parent’s ability to pay.

- Submit the Application:

Send the completed application to the Texas Attorney General’s Child Support Division. You can typically submit it online, by mail, or in person at your local child support office. Be sure to keep copies of all documents for your records.

- Pay the Application Fee (if applicable):

Depending on your income and circumstances, there may be an application fee. If you qualify for certain government assistance programs, this fee may be waived.

- Case Processing:

After receiving your application, the Child Support Division will review the information and establish a case. They will attempt to locate the other parent and verify income and employment information.

- Court Order Establishment:

If the other parent does not voluntarily agree to child support terms, the Child Support Division may initiate a legal process to establish a court order. This can involve a court hearing where a judge determines child support terms.

- Child Support Payments:

Once a child support order is in place, payments will typically be made through wage withholding (deducted from the other parent’s paycheck) or other methods. Ensure you provide accurate bank account information for direct deposit if required.

- Monitor and Enforce:

You can monitor child support payments through the Texas Child Support Interactive website. If the other parent fails to make payments, you can contact the Child Support Division for enforcement options.

- Modify the Order (if necessary):

If circumstances change, such as a significant change in income or custody arrangements, you can request a modification of the child support order.

- Seek Legal Assistance (if needed):

If you encounter complex legal issues or face challenges in the child support process, consider consulting with a Texas family law attorney for guidance and representation.

Modifying Child Support

Modifications to child support orders can be necessary due to changing circumstances or unforeseen events. It is important to understand the process and requirements for modifying child support orders in Texas to ensure the best interests of the child are met.

In Texas, a modification can be requested if there has been a substantial change in circumstances that affects the child support obligation. This can include:

- changes in income

- employment status

- health needs of the child

- or any other significant factor that impacts the financial situation of the parents or the well-being of the child.

To initiate a modification, the requesting party must file a petition with the court that issued the original child support order. It is crucial to provide evidence and documentation supporting the claim for modification, such as recent pay stubs, medical records, or any other relevant information that demonstrates the change in circumstances.

Once the petition is filed, a hearing will be scheduled where both parties can present their arguments and evidence. The court will then evaluate the information provided and make a decision based on the best interests of the child.

Child Support and Parenting Time

When parents agree to equal parenting time, the calculations for child support become more complex. In these cases, it is important to speak with an attorney in order to understand exactly how your court will award child support.

In some cases, a judge may not order any child support if the parents have similar incomes. Medical and dental support are still required by law, however. Alternatively, a judge may order each parent to cover the costs of necessities during their respective possession times (e.g., food, housing) and split general expenses (e.g., tuition, extracurricular activities) evenly. Lastly, a judge might calculate what each parent would be responsible for if either one had been deemed the custodial parent, then order the higher-paying parent to pay the difference to the other.

Regardless of the exact details, it is essential to stay informed about how the courts will proceed when settling equal custody arrangements – so that you can provide for your children the best you can.

Child support for disabled children over 18 in Texas

If you are a parent of an adult child with disabilities in Texas, it is important to know your rights and understand the legal requirements surrounding child support. Generally, a paying parent must continue contributing until the child turns 18 or graduates from high school, whichever comes first. Depending on the case, resources may be counted and the amount of child support owed may change.

TEX. FAM. CODE § 154.302(a) makes special exceptions for those with a disabled adult child. When one or both parents can prove that their adult disabled child requires substantial care and personal supervision due to mental or physical disability, they can request an indefinite extension of child support payments. How much will be paid is based on each family’s individual situation and is decided by a judge. The goal is to ensure that the disabled adult child is getting the care and financial assistance they need while not overburdening either parent.

Additionally, the Department of Family and Protective Services (DFPS) may intervene to provide temporary or permanent conservatorship if the parents are unable to properly care for their adult disabled child. In such cases, the court will order periodic support payments from either or both parents who have the financial means to do so. An amendment made in September 2021 requires that notice of any modifications in child support arrangements with the DFPS must be given to the attorney general no later than 10 days after the order is issued.

Texas Child Support and Lower Income

In accordance with Tex. Fam. Code § 154.125, child support is determined based on a percentage of monthly net resources rather than a percentage of income.

The state of Texas establishes specific guidelines for calculating child support, commonly referred to as “guideline child support.”

In child support cases filed on or after September 1, 2021, a reduced proportion of child support will be deducted if the noncustodial parent’s monthly net resources amount to $1,000 or less.

| Number of Children | Monthly Income of Obligor | Percentage of Income (as per guidelines) | Percentage of Net Resources |

| 1 | $1,000 | 15% | $150 (15% of $1,000) |

| 2 | $1,000 | 20% | $200 (20% of $1,000) |

| 3 | $1,000 | 25% | $250 (25% of $1,000) |

| 4 | $1,000 | 30% | $300 (30% of $1,000) |

| 5 | $1,000 | 35% | $350 (35% of $1,000) |

| 6 or more | $1,000 | Not less than the amount for five children | Not less than $350 |

Please be aware that these are simplified figures for illustrative purposes only and may not reflect the exact 2025 low-income child support guidelines in Texas. Child support calculations can also take into account various deductions, credits, and adjustments, so consult with a legal professional for accurate calculations.

Health Insurance and Medical Support

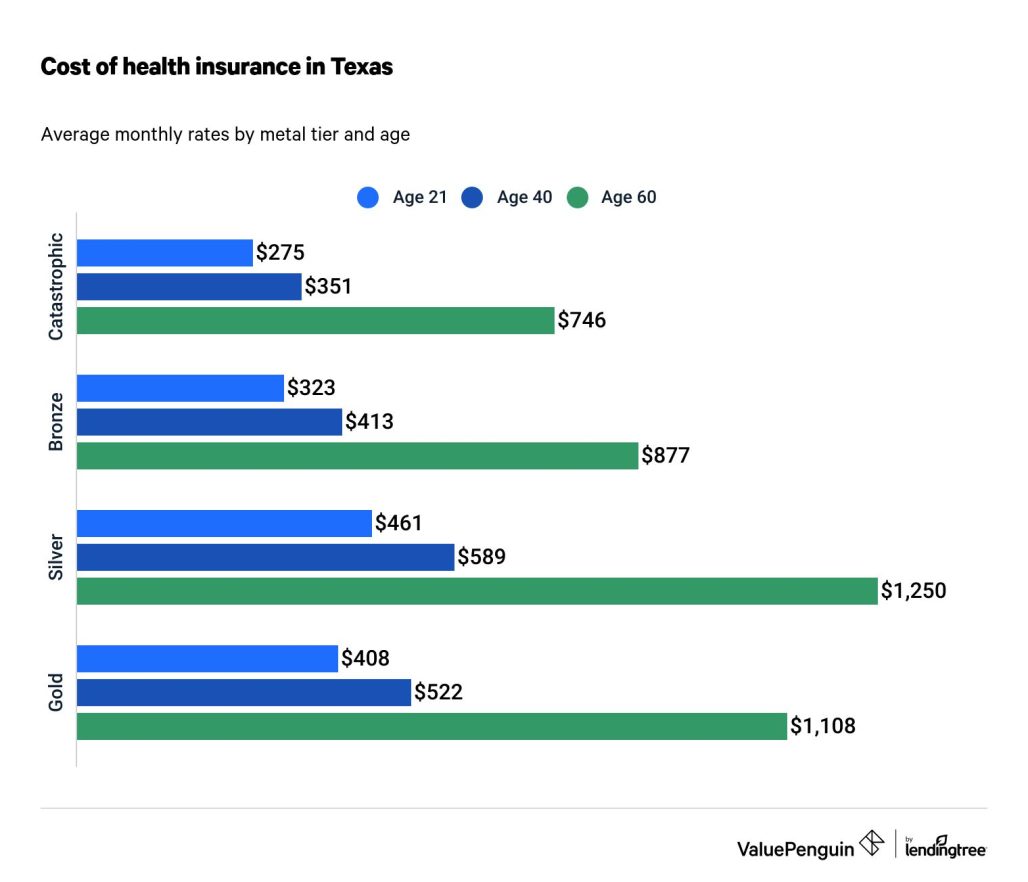

When it comes to medical and dental support for a child, parents are typically responsible for providing coverage through their employer-sponsored insurance. If this is not possible, the parent receiving child support may be ordered to obtain coverage via their employer. Additionally, if neither parent can provide insurance or if the child is already covered by Medicaid, the paying parent will usually be required to issue a set dollar amount each month. In addition, both parents are generally obligated to split expenses for out-of-pocket costs associated with medical or dental care.

Under Texas law, parental contributions toward health and dental insurance should not exceed 9% of gross yearly income for health insurance or 1.5% for dental insurance. While these costs may seem high at times, they are far outweighed by the peace of mind that comes with providing proper care for your child. With the right insurance in place, you can ensure that your children receive the best possible treatment and medical care.

Payments must always be made through the Texas Child Support Disbursement Unit—never directly to the other parent.

Texas State Disbursement Unit (SDU)

PO Box 659791

San Antonio, TX 78265-9791

This helps to ensure that payments are properly documented and verified. To achieve this, a judge will typically issue an Income Withholding Order for Support to the employer of the paying parent. The withholding order dictates the exact amount that should be deducted from each paycheck and forwarded to the Disbursement Unit. Though this is standard procedure, parents have the option to agree on an alternate payment method outside of court, so long as it is approved by the court.

Non-Payment and Legal Consequences

The Texas Legislature and Governor Greg Abbott have recently passed Senate Bill 869, introducing specific amendments to the Texas Family Code (TFC) to improve the child support collection process. These amendments, proposed by the Child Support Division of the Texas State Attorney General’s Office, took effect on September 1, 2023, so it’s important to know how it affects families in Texas.

For instance, if an individual with overdue child support payments comes into an inheritance, they are now obligated to use that money to settle their unpaid child support. Additionally, electronic signatures are now permitted on waivers of citation in a suit affecting parent-child relationships, streamlining the initiation of cases. Furthermore, email addresses are required to be included in all final orders involving children to facilitate contact after court and simplify service when necessary.

Additionally, lump sum Social Security Disability payments received by both a parent and their child can now be used to offset any existing child support arrearage. It’s also important to note that child support arrearages cannot be reduced for any reason and paternity suits still can continue even if the presumed father is not available. Finally, renewable child support liens will now remain in effect indefinitely, ensuring that child support arrears can be pursued with no time constraints.

Appealing Child Support Decisions

If you’ve had an unfavorable family court decision in Texas, you may be considering filing an appeal. But how exactly does the process work? Don’t worry – here’s a comprehensive guide to everything you need to know about appealing a family court decision.

A successful appeal doesn’t just rely on disagreement with the trial’s verdict – it requires proof that the judge failed to follow proper legal protocols or exceeded their authority when making decisions about your case. Since family law cases are heavily dependent on the specific details of your situation, a good understanding of evidence and the judge’s interpretation of it is essential. It’s worth noting, too, that appellate courts typically offer judges a large amount of discretion when making decisions in family cases.

So, uncover the intricacies of the appeal process and learn more about the potential challenges you may face in successfully navigating it. With this knowledge in hand, you’ll have all the necessary tools to make an informed decision moving forward.

Resources and Support

Navigating the child support process in Texas can be overwhelming and confusing, especially if you’re unfamiliar with the guidelines and regulations. Fortunately, there are several helpful resources and tips available to assist you in this journey.

Texas Attorney General’s Office

The Texas Attorney General’s Office is a valuable resource for information on child support guidelines and processes. Their website provides comprehensive guides, forms, and calculators to help you understand and navigate the child support system effectively. You can also find contact information for local child support offices, where you can seek further assistance if needed.

Online Support Calculators

Various online child support calculators specifically tailored for Texas are available to help you estimate child support amounts. These calculators take into account factors such as the number of children, income, and custody arrangements. While these calculators can provide a general idea, it’s crucial to consult with a legal professional to ensure accuracy and compliance with the official guidelines.

- csapps.oag.texas.gov/monthly-child-support-calculator

- custodyxchange.com/locations/usa/texas/child-support-calculator.php

Seek Legal Advice

Navigating the child support process can be complex, especially if there are unique circumstances involved. It’s highly recommended to consult with an experienced family law attorney who specializes in child support cases. They can provide personalized guidance based on your specific situation, ensuring that you understand your rights, obligations, and options.

Mediation Services

If you and the other parent are open to amicable negotiations, mediation services can be a beneficial option. Mediators specialize in facilitating constructive discussions between both parties to reach a mutually acceptable child support arrangement. Mediation can often provide a more cooperative and less adversarial approach, reducing stress and time spent in court.

FAQs and Common Issues

What are the rules for child support in Texas?

Child support in Texas is calculated based on a number of factors, including both parents’ incomes and the custody arrangement. The court will also consider any special medical or educational needs that the children may have. The noncustodial parent is typically expected to pay the custodial parent a proportionate share of the children’s costs.

What is the minimum child support per child in Texas?

The minimum basic child support obligation for one child in Texas is $100 per month. However, additional amounts may be required depending on the individual situation.

What is the maximum guideline for child support in Texas?

The maximum amount of guideline child support in Texas depends on the combined net income of both parents. It cannot exceed the highest total of guideline support for any number of children in accordance with the Texas Child Support Guidelines table.

What are the child support guidelines for 2025 in Texas?

Parents can find the current guidelines for 2025 on the Texas Attorney General’s website. These guidelines provide a framework for calculating child support payments according to each parent’s income, the number of children, and other factors.

What is the average child support payment in Texas?

The average child support payment in Texas varies from case to case. Typically, it ranges anywhere from $500 to $2,000 per month depending on the family’s particular circumstances.

What percentage of income does Texas take for child support?

Generally, the court will require the noncustodial parent to pay twenty percent (20%) of their net resources, up to a maximum of $4,500 based on the CSE Guidelines.

Is child support required with 50-50 custody in Texas?

Even if parents have an equal time-sharing arrangement, one parent may still be legally obligated to pay child support to the other. The court will evaluate each parent’s financial situation and determine whether or not they meet the criteria for paying or receiving child support payments.

Is child support based on a 40-hour work week in Texas?

Child support payments in Texas are generally based on what is considered a “normal” 40-hour workweek. However, this can vary depending on a parent’s job type or occupation. The court will consider all factors when determining the appropriate level of support.

How do I avoid child support in Texas?

There is no legal way to avoid paying child support in Texas without a court order. To seek relief from your obligations, you must go through the court process and obtain an official modification or termination of your child support order.

Can a father stop paying child support in Texas?

A father cannot legally stop paying child support without a court order stating that his responsibility has ended. In some cases, such as when a child reaches majority age, a father may be released from his obligation, but he must follow established procedures to do so.

What does child support not cover in Texas?

Child support in Texas typically covers basic necessities such as food, clothing, and shelter, as well as medical expenses and extracurricular activities. It does not cover college tuition, travel costs, or any other expenses that are not deemed necessary by the court.

Does the custodial parent’s income affect child support in Texas?

Yes, the custodial parent’s income may have an impact on how much child support is paid by the noncustodial parent. If the custodial parent earns enough money to provide adequately for the children, then it is possible that the noncustodial parent may be released from their obligation to pay child support.

Glossary

This glossary provides explanations for key terms commonly used in Texas child support cases, presented in alphabetical order for easy reference.

- Arrears: Unpaid child support that has accumulated over time. Arrears can result in legal actions to enforce payment.

- Child Support: Financial support paid by one parent to another for the care and well-being of their child or children.

- Child Support Arrears Forgiveness Program: A program that may allow the reduction or forgiveness of past-due child support under certain circumstances.

- Child Support Guidelines: Texas state laws and regulations that govern the calculation of child support payments based on the obligor’s income and the number of children.

- Child Support Order: A legally binding court order that specifies the amount of child support payments, the payment schedule, and other related terms.

- Child Support Review and Adjustment (CSR&A): A process initiated by the Texas Child Support Division to periodically review and adjust child support orders as needed.

- Contempt of Court: A legal action that can be taken against an obligor who fails to comply with a court-ordered child support payment plan, potentially resulting in fines, garnished wages, or even imprisonment.

- Custodial Parent (CP): The parent who has primary physical custody of the child and receives child support payments.

- Custody and Visitation (Parenting Time): Agreements or court orders that outline the legal and physical custody of the child and visitation schedules for the noncustodial parent.

- Guideline Child Support: Child support amounts are calculated based on guidelines established by Texas law, taking into account factors such as the number of children and the obligor’s income.

- Income Withholding: The process of deducting child support payments directly from the obligor’s paycheck before they receive their wages.

- Income Withholding Order (IWO): A legal document that requires an employer to withhold child support payments from the obligor’s wages and send them directly to the Texas Child Support Division.

- Medical Support Order: A court order that establishes the obligor’s responsibility for providing health insurance coverage for the child and sharing medical expenses.

- Net Resources: The income used to calculate child support payments, which may include wages, bonuses, rental income, and other sources, minus certain deductions.

- Noncustodial Parent (NCP): The parent who does not have primary physical custody of the child and is typically responsible for making child support payments.

- Obligee: The parent who receives child support payments on behalf of the child or children, often referred to as the “custodial” or “receiving” parent.

- Obligor: The parent who is legally obligated to make child support payments, often referred to as the “paying” or “noncustodial” parent.

- Texas Attorney General’s Child Support Division: The state agency responsible for administering and enforcing child support orders in Texas.

- Child Support Review and Modification: The process of reviewing and, if necessary, modifying child support orders due to significant changes in circumstances, such as income or custody arrangements.

- Texas Child Support Review and Adjustment (CSR&A): A process initiated by the Texas Child Support Division to periodically review and adjust child support orders as needed.

Final Word

We hope you found our blog post on Texas child support in Texas informative and helpful. Navigating the complexities of child support can be overwhelming, but having a clear understanding of the guidelines is crucial. Our article provided you with the necessary information and tips to ensure you are well-equipped to navigate the Texas child support system confidently. Remember, every situation is unique, so it’s always best to consult with a legal professional for personalized advice. We wish you success in managing your child support responsibilities and ensuring the well-being of your children.

Child support in Texas is governed by the Texas Family Code. The noncustodial parent is typically required to make regular payments to the custodial parent to help cover the child’s expenses. The amount of child support is determined based on various factors, including the noncustodial parent’s income, the number of children involved, and any special needs of the child. The court may also consider other factors such as the cost of health insurance and daycare expenses. It’s important to consult with a family law attorney or visit the Texas Attorney General’s website for more detailed information on how child support works in Texas.