What is Not Community Property in a Divorce in California?

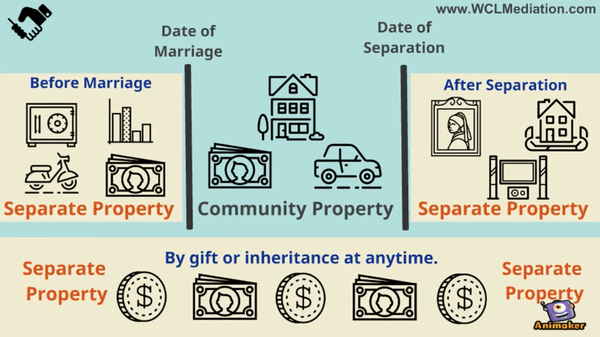

California operates under community property laws for divorce, ensuring assets and debts acquired during marriage are evenly divided. This system aims for a 50/50 distribution, differing from states that use equitable distribution, where division is based on fairness, not equality. For those approaching separation, distinguishing between “community” and “separate” property is vital, as it directly affects the division process under the law.

Separate vs. Community Property

Community and separate property are two distinct categories in a California divorce case. State law defines community property as any assets, money, or debts acquired during a marriage or domestic partnership by one or both spouses. Separate property refers to assets acquired before the marriage. While a few exceptions to the rule exist, these definitions generally apply to all types of properties in a divorce case.

In a divorce, all property owned by you and your spouse will be labeled as either community or separate property (or in rare cases, a commingling of the two). This labeling process will determine how the property is divided when the divorce is finalized.

| Aspect | Community Property | Separate Property |

|---|---|---|

| Definition | Owned jointly by both spouses if acquired during marriage in a community property state. | Owned individually, acquired before marriage, or through inheritance/gifts. |

| Examples | Includes wages, investment income, and property bought during marriage. | Comprises gifts, inheritances, personal investments (IRAs, 401(k)s), and property bought before marriage. |

| Tax Reporting | Income split 50/50 for separate filings. | Individual income is reported fully by the owner for separate filings. |

| States | AZ, CA, ID, LA, NV, NM, TX, WA, WI. | Recognized in all states; specifics vary outside community property states. |

| Divorce Considerations | Divided equally regardless of acquisition. | Remains with the original owner; not divided. |

Community Property

California is a community property state, meaning that a marriage or registration of domestic partnership makes two people one legal “community.” Any property or debt acquired by one person during the marriage or partnership is seen as belonging to the community, and not the individual that accrued it. In Cal. Fam. Code § 760, community property is defined as

“all property, real or personal, wherever situated, acquired by a married person during the marriage while domiciled in the state.”

At the end of a divorce, community property is generally split 50/50.

The state’s definition of community property is intended to be an umbrella classification covering many categories of property and possessions. The state relies on a host of additional statutes that delineate whether real property or personal property is community or not, depending on various interweaving factors and stipulations.

Exceptions to Community Property in California

Generally, community property is defined as all property, real or personal, wherever situated, acquired by a married person during the marriage while domiciled in the state. However, not all property acquired during the marriage falls into this category. Here are the main exceptions:

- Property Acquired by Gift, Bequest, Devise, or Descent:

This includes property that one spouse inherits or is given as a gift, either before or during the marriage. It is considered a separate property. - Property Acquired Before Marriage:

Any property owned by either spouse before the marriage remains that spouse’s separate property. - Property Acquired After a Legal Separation:

Property acquired by a spouse after a legal separation has been declared is not considered community property. - Property Purchased with Separate Property Funds:

If the property is purchased with the separate funds of one spouse (for example, money inherited by that spouse), it remains a separate property. - Personal Injury Awards:

Compensation for personal injuries sustained by a spouse during the marriage is typically considered the separate property of the injured spouse, except for any part of the award that compensates for lost earnings or medical expenses paid from community property. - Agreements Between the Spouses:

Spouses can enter into agreements, either before (premarital agreements) or during the marriage, that classify property as separate that might otherwise be considered community property. - Income from Separate Property:

While income from separate property is generally considered community property, parties can agree otherwise, and such agreements are typically upheld if they meet legal requirements.

Separate Property

Property that one party owned before the marriage is not owned by the “community,” and thus is treated as separate, and not community property. Separate property also encompasses gifts and inheritance specifically given to one party, and property purchased or earned after the separation. This is the principal reason why the date of separation is so important in so many divorces and should be recorded and discussed with your attorney as soon as it occurs.

Any property that is bought with separate property is also separate, even if it is bought during the marriage. For example, if you purchase a car after your marriage with money you made before the marriage, that car can still be seen as separate property. Rent or income earned from separate property continues to be separate as well — so money or rent earned from businesses or real estate owned before the marriage will exist as separate property, as long as it isn’t mixed with community assets.

Examples Of Separate Property

Community property can include all earnings, income, profits from investments, financial obligations, furniture, homes, vehicles, art, jewelry, pension plans, 401(k)s plans, life insurance, businesses, security deposits, cash, and other assets and debts one or both spouses acquired during the marriage or registered partnership. Assets that are not community property can include anything acquired by either spouse before the marriage or domestic partnership. There are many examples of separate property in California.

- Pre-Marital Assets: Assets owned before marriage, such as bank accounts, investments, properties, and assets not mixed with the spouse’s property.

- Inheritances/Gifts: Any inheritance or gift received by one spouse at any time, remaining separate even if used by the other spouse.

- Separate Property Profits: Income from separate property, like investment returns or rent from real estate, remains separate.

- Post-Separation Acquisitions: Assets acquired after physical or legal separation, despite still being legally married or in a domestic partnership.

Once you combine your assets, they become community property. If you wish to protect your separate property in case of divorce, therefore, you must keep it separate or sign a prenuptial agreement. Keeping assets separate may take maintaining separate bank accounts and not adding your spouse’s name to titles or deeds after marriage. You could also protect your assets by creating a prenuptial or postnuptial agreement with stipulations giving you ownership over the asset in question after a divorce. A prenuptial/postnuptial agreement will only stand up in court, however, if it is legally binding.

Complications can also occur if one spouse has money in a bank or investment account pre-marriage, and then places the spouse’s name on the account, deposits community earnings, or uses the account to pay community debt. These cases often come down to employing a forensic accountant to follow the money review the history of transactions during the marriage, and divide the leftover money into separate or community property.

FAQ on Community Property in California

What are community property rules in CA?

In California, community property includes all assets, debts, and income acquired by either spouse during the marriage. This encompasses salaries, real estate, and investments, among other things. Upon divorce, community property is divided equally between the spouses, regardless of individual contributions.

How long do you have to be married in California to get community property?

There’s no minimum duration of marriage required for property to be considered community property in California. Assets and debts acquired by either spouse during the marriage are considered community property from the moment of marriage until the date of separation.

Are separate bank accounts marital property in CA?

Separate bank accounts are not considered marital (community) property if they were established before the marriage and maintained separately without commingling funds. However, income deposited into these accounts during the marriage is considered community property.

What is the mandatory California approach to community property?

The mandatory approach in California is to equally divide all community property between the spouses in a divorce. This division is based on the principle that all assets and debts acquired during the marriage belong equally to both spouses, irrespective of who earned more or acquired more assets.

What is not considered community property in CA?

Assets that are not considered community property include those acquired before the marriage, after separation, or at any time by gift, bequest, devise, or descent. Additionally, profits from separate properties remain separate, provided they are not commingled with community assets.

How can I avoid community property in California?

To avoid community property rules, spouses can enter into a prenuptial or postnuptial agreement specifying different terms for their assets. Keeping assets and accounts separate and not commingling them with marital assets is also crucial.

What is the 10-year rule for marriage in CA?

The 10-year rule in California typically refers to spousal support and eligibility for benefits, such as Social Security from a former spouse. It does not directly affect the division of community property in a divorce.

Can my wife take my house if I bought it before marriage in California?

If you bought your house before marriage and maintained it as separate property (not commingling it with marital funds or assets), it is considered separate property and not subject to division as community property in a divorce.

Can you waive community property in CA?

Yes, spouses can waive their rights to community property through valid prenuptial or postnuptial agreements, where they agree to different terms for the division of their property in the event of a divorce.

Final Word on Community Property in California

Community property encompasses almost all earnings and acquisitions during the marriage, while separate property includes assets owned before marriage, gifts, inheritances, and earnings post-separation. Despite the seemingly straightforward division, exceptions such as assets acquired through inheritance or gifts, property bought with separate funds, and the nuances of legal separations introduce complexity.

Given the intricate nature of these laws and the potential for significant financial impact, it’s crucial to accurately identify and understand the nature of one’s assets early in the separation process. For those facing divorce, careful consideration with the guidance of legal counsel, can help navigate the complexities of California’s community property system, ensuring a division that respects the legal framework while acknowledging individual circumstances and contributions.