Contents

- Navigating Divorce and Retirement: Why You Need a QDRO Attorney

- What is a QDRO?

- Benefits of a QDRO

- Fair Division of Retirement Assets

- Tax Implications of QDROs

- Cost of a QDRO Attorney

- Find a QRDO Attorney in Your Area

- Mistakes to Avoid with QDROs

- FAQs about QDROs

- What exactly is a QDRO?

- What are the rules of a QDRO?

- Are QDROs necessary for all divorce cases?

- Is a QDRO retroactive?

- Who prepares a QDRO?

- What is a QDRO processing fee?

- How long does it take for a QDRO to be completed?

- What is the 59 1 2 rule?

- Can a QDRO be modified or revoked?

- How long does it take to finalize a QDRO?

- Can a QDRO be used to collect child support or alimony payments?

- Do QDROs apply to all types of retirement plans?

- What happens if a QDRO is never filed?

- Who pays the income tax on a QDRO?

- Can I empty my 401K before divorce?

- What is the penalty for using a QDRO?

- Final thoughts

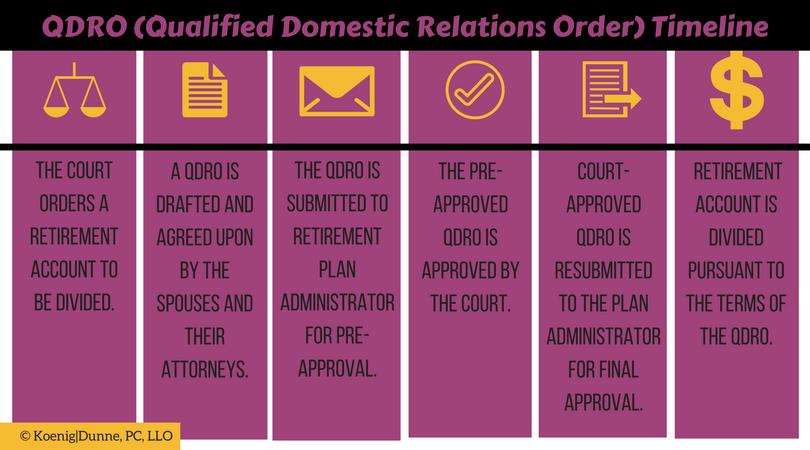

When navigating the complex intersection of divorce and retirement, having a qualified domestic relations order (QDRO) attorney by your side is crucial. But what exactly does a QDRO attorney do, and why do you need one?

A QDRO attorney specializes in the legalities surrounding the division of retirement assets during a divorce. QDROs are court-ordered documents that outline how retirement benefits, such as 401(k) plans or pension funds, will be divided between the divorcing parties. These orders are essential to ensure a fair and equitable distribution of retirement assets.

One of the main roles of a QDRO attorney is to provide expert guidance and representation throughout the divorce process. They deeply understand the complex laws and regulations governing retirement plans and can help you navigate the intricacies of dividing these assets. They will review the specific details of your retirement plans, analyze their value, and work with you to develop a strategy for dividing them to align with your goals and best interests.

What is a QDRO?

Understanding the purpose and benefits of a Qualified Domestic Relations Order (QDRO) is crucial for anyone going through a divorce or separation that involves the division of retirement assets. A QDRO is a legal document that establishes the rights of an alternate payee, typically a former spouse, to receive a portion of the other party’s retirement benefits.

The main purpose of a QDRO is to ensure a fair and equitable distribution of retirement assets between both parties. Without a QDRO, the division of retirement benefits can be complex and may result in significant tax consequences and financial hardships for one or both parties.

Main components of QRDOs

- Identification of the retirement plan(s) involved. This includes specifying the name of the plan, the plan administrator, and any applicable account numbers. It is important to gather all the necessary information to ensure the accurate distribution of retirement assets.

- Identification of the parties involved. This includes the names of both the participant (the party whose retirement assets are being divided) and the alternate payee (usually the ex-spouse who will receive a portion of the retirement benefits). It is essential to provide accurate and detailed information about both parties to avoid any complications during the implementation of the QDRO.

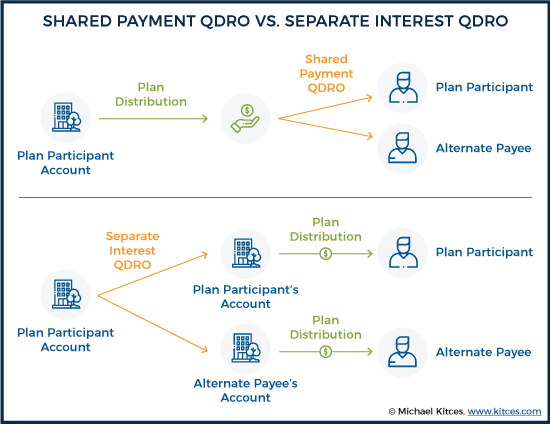

- The division of benefits. This entails specifying the percentage or dollar amount to be allocated to the alternate payee. It is important to note that the division of benefits can vary depending on the specific retirement plan and the terms agreed upon in the divorce settlement. Therefore, it is crucial to consult with a qualified attorney or financial professional to ensure the division is in compliance with the plan’s rules and regulations.

- The method of distribution. This includes determining whether the alternate payee will receive a lump sum payment, periodic payments, or a combination of both. The QDRO should provide clear instructions on how and when the benefits will be distributed, taking into consideration any tax implications and the preferences of both parties involved.

- Address any contingencies or special circumstances that may arise. This could include provisions for survivor benefits, early retirement, or disability benefits. By including these details in the QDRO, both parties can have peace of mind knowing that their interests are protected and accounted for.

A Qualified Domestic Relations Order (QDRO) must include the following information to be accepted:

- names and last known addresses of both the participant and any alternate payees;

- unique identifier (account number) for the retirement plan in question;

- percentage or dollar amount of benefits to be paid out to each alternate payee, along with details on how this amount is calculated;

- period over which such payments will be made, or instructions on how this period should be calculated;

- description of each source or type of benefits to be distributed; any necessary waivers of rights to future benefits;

- and finally, any additional clauses needed to complete the process.

The QDRO also needs to specify how disputes over the order are to be resolved to ensure that the division of benefits is carried out accurately and efficiently. With all of these pieces in place, the QDRO can help ensure that retirement benefits are appropriately and equitably divided.

Benefits of a QDRO

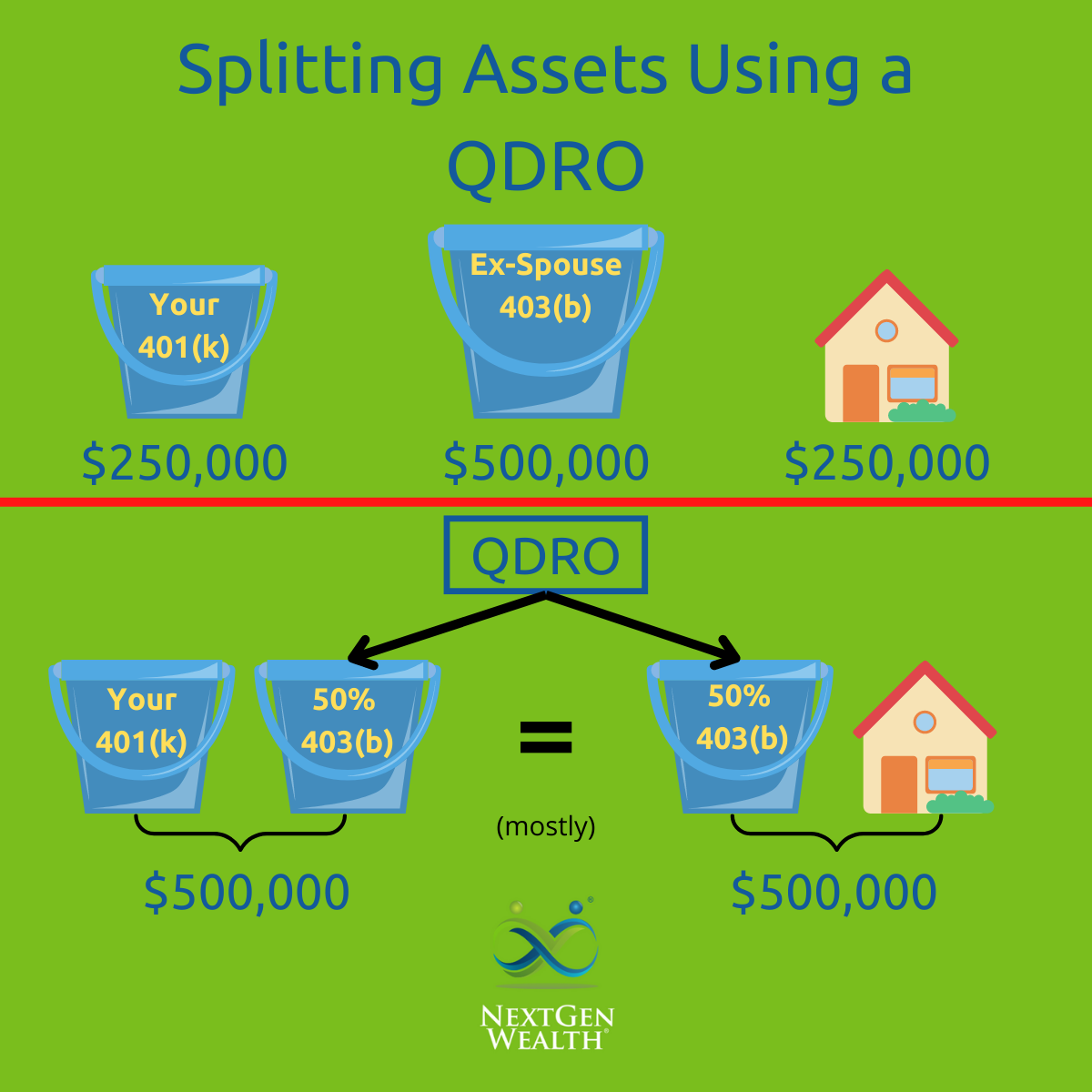

A QDRO is a specialized court order that outlines how retirement benefits will be divided between divorcing spouses. It is necessary when dividing retirement plans such as 401(k)s, pensions, and other qualified retirement accounts.

The key benefit of a QDRO is that it allows for the tax-free transfer of retirement funds from one spouse’s account to the other. This means that the recipient spouse can roll over the funds into their own retirement account without incurring any immediate tax liabilities. It also provides a clear legal framework for the division of retirement benefits, ensuring that both parties receive their fair share in accordance with the applicable state laws and regulations.

- Retirement Asset Division: A QDRO allows the division of retirement funds between spouses without incurring early withdrawal penalties or tax consequences.

- Tax Efficiency: The transfer of retirement funds pursuant to a QDRO can be tax-free, avoiding immediate taxation on the division of assets.

- Retirement Account Preservation: The QDRO allows the non-employee spouse to maintain their share of the retirement account in a tax-advantaged retirement vehicle, preserving its growth potential.

- Financial Security: The non-employee spouse gains a source of income during retirement, providing financial security after divorce.

- Customizable Division: QDROs can be tailored to meet the specific needs and circumstances of the divorcing couple, ensuring a fair and equitable division of retirement assets.

- Spousal Support: The QDRO can be used to fulfill spousal support or alimony obligations, helping the receiving spouse maintain financial stability.

- Estate Planning: In the event of the employee spouse’s death, the QDRO can ensure that the non-employee spouse remains the beneficiary of the allocated portion of the retirement account.

- Protection from Bankruptcy: Funds allocated through a QDRO may receive additional protection from creditors in case of financial difficulties.

- Social Security Benefits: The non-employee spouse may be entitled to claim a portion of the employee spouse’s Social Security benefits if the marriage lasted at least ten years and other eligibility criteria are met.

QDROs are specific to retirement plans governed by the Employee Retirement Income Security Act (ERISA). Different types of retirement plans, such as 401(k)s, pensions, and military or government plans, may have their own unique requirements and regulations regarding QDROs.

By hiring a QDRO attorney, you can navigate the complexities of dividing retirement assets with confidence and peace of mind. These attorneys have the expertise and knowledge to draft and negotiate QDROs that protect your interests and ensure a fair division of retirement benefits.

Fair Division of Retirement Assets

Qualified Domestic Relations Orders (QDROs) can significantly impact various types of retirement plans, including 401(k) accounts, pensions, and other retirement savings vehicles. Understanding how QDROs apply to each type of plan is crucial to ensure a fair and equitable division of assets during a divorce or separation.

401(k)

When it comes to 401(k) accounts, a QDRO allows for transferring a portion of the account balance to the non-employee spouse. This transfer can be made either as a lump sum or through periodic payments. It is important to note that the non-employee spouse may be subject to taxes and early withdrawal penalties if the funds are not rolled over into an eligible retirement account.

Pensions

Pensions present unique challenges in dividing assets through QDROs. A QDRO can divide both vested and non-vested pension benefits, ensuring that the non-employee spouse receives a fair share of the retirement income. However, the process of valuing and dividing pension benefits can be complex and may require the assistance of an actuary or financial expert.

IRAs and Government-sponsored Plans

Other types of retirement plans, such as IRAs and government-sponsored plans, may also be subject to division through QDROs. Each plan has its rules and regulations, so it is essential to consult a qualified attorney or financial professional to navigate the intricacies of dividing these assets.

Tax Implications of QDROs

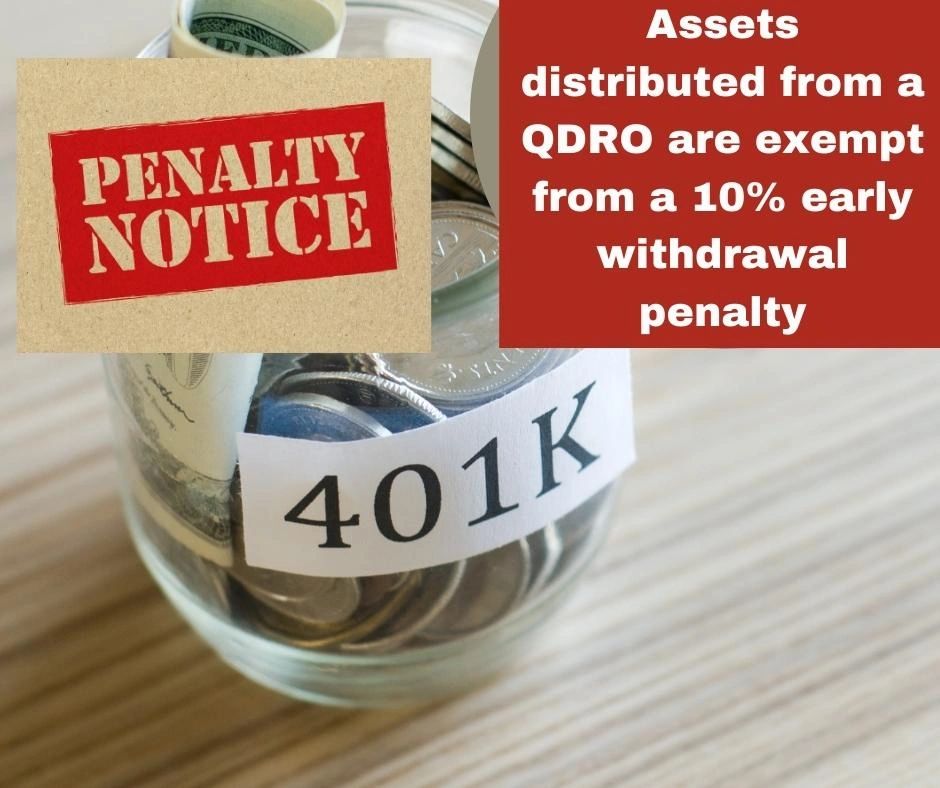

QDROs are not exempt from taxes. Any distributions made from a retirement account as a result of a QDRO are subject to regular income taxes. If a portion of a retirement account is transferred to a former spouse or dependent, they will be responsible for paying taxes on the distributed amount.

Early Withdrawal Penalties

If a recipient of a QDRO decides to withdraw funds from their portion of the retirement account before reaching 59 and a half, they may be subject to an additional 10% penalty on top of the regular income taxes.

However, if the distributed amount is rolled over into an Individual Retirement Account (IRA) or another qualified retirement plan, the taxes can be deferred until the funds are eventually withdrawn. Per the IRS:

An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO. If a person receiving QDRO payments is either the employee’s spouse or former spouse (not as a nonspousal beneficiary), then he or she can roll it over, just as if he or she were the employee receiving a plan distribution and choosing to roll it over. – irs.gov

Consult with a tax professional or financial advisor to fully understand the specific tax implications related to your unique situation. They can provide personalized guidance based on your circumstances and help you navigate the complexities of QDROs and their associated tax considerations.

Cost of a QDRO Attorney

If you’re going through divorce proceedings that involve a Qualified Domestic Relations Order (QDRO), you may be wondering about the associated lawyer costs. When it comes to QDRO lawyer fees, it’s important to make sure you know exactly what’s included in the preparation and filing process. Most attorney fees include the cost of drafting and filing the QDRO but may not include other administrative fees. To get a better idea of the full price, ensure that you work with a lawyer who understands these additional fees and can advise you on the best route for reducing costs.

QDRO Preparation Cost

QDRO Preparation is a specialized service for Texas attorneys to divide assets and liabilities in order to satisfy a divorce decree. When assisting an attorney, the fee for preparation is $400 per order. Clients that are not represented by an attorney can have their QDRO prepared for a flat fee of $400 under specific terms and conditions, such as providing necessary information and documents, paying any filing fees, and submitting the QDRO to the Court that granted the divorce.

If you use these forms to divide retirement funds, you will need to obtain an additional court order, usually called a “qualified domestic relations order” (QDRO), to make the division effective. A QDRO form is not included in this Divorce Set. It is recommended that you hire a lawyer to prepare a QDRO. If you and your spouse keep your own retirement funds or do not have any retirement funds, you do not need a QDRO. – txcourts.gov

Companies that create QDROs may not always offer an attorney for the entire legal process. To ensure everything is being handled properly, it is best to enlist the services of a certified divorce lawyer with knowledge of both retirement plans and relevant state regulations.

Plan Administrator Fees

Plan administrators often add a fee when processing a QDRO, and these charges can range from $500 to $1,200 or more, depending on the type of plan involved. Although this may seem like a substantial cost, financial advisors can act as fiduciaries to help negotiate lower fees for their clients.

Attorney Fees

If you are considering obtaining a QDRO (Qualified Domestic Relations Order), it is highly advised that you hire a qualified lawyer. It is true that the paperwork and filing fees associated with a QDRO typically fall within the realm of what the lawyer will need to do, as listed in the previous section. However, you may be surprised to learn that there can be further costs for extra services such as re-drafting the QDRO in case it has been rejected by the plan administrator.

Find a QRDO Attorney in Your Area

You may need to zoom out on the map depending on your area.

Mistakes to Avoid with QDROs

When it comes to drafting or reviewing Qualified Domestic Relations Orders (QDROs), it is crucial to be aware of common mistakes that can have significant implications. These mistakes can lead to delays, legal disputes, and financial losses for all parties involved. Avoid the following pitfalls:

1. Lack of specificity

A vague or ambiguous QDRO can result in confusion and disagreements down the line. It is vital to be precise and clear in describing the division of retirement benefits, including the type of plan, account numbers, and the exact percentage or amount to be allocated.

2. Failure to consider tax implications

QDROs can have tax consequences for both the participant and the alternate payee. Ignoring these implications can lead to unexpected tax liabilities or missed tax advantages. It is crucial to consult with a tax professional to understand the potential tax consequences before finalizing the QDRO.

3. Inadequate legal language

QDROs are legal documents that need to comply with specific state laws and plan requirements. Using generic or outdated language can render the order invalid or unenforceable. Working with an experienced family law attorney or qualified QDRO specialist is essential to ensure that the document accurately reflects the parties’ intentions and meets all necessary legal standards.

4. Failure to address survivor benefits

Survivor benefits are often overlooked when drafting QDROs. It is important to consider how the division of retirement assets will impact the alternate payee’s rights in the event of the participant’s death. Addressing these concerns in the QDRO can help avoid future disputes or unexpected financial hardships.

5. Lack of communication and collaboration

QDROs involve multiple parties, including the participant, the alternate payee, attorneys, and plan administrators. Failing to communicate effectively or collaborate with all stakeholders can lead to misunderstandings, delays, and mistakes. Open and transparent communication throughout the process is crucial to protect everyone’s rights and interests.

FAQs about QDROs

QDROs, or Qualified Domestic Relations Orders, can often be a confusing topic. To help shed some light on this complex legal process, we have compiled a list of frequently asked questions to address common concerns and misconceptions surrounding QDROs.

What exactly is a QDRO?

A QDRO is a legal order that outlines how retirement benefits, such as pensions or 401(k) plans, will be divided between spouses during a divorce. It allows for transferring these assets without incurring tax penalties or early withdrawal fees.

What are the rules of a QDRO?

There are several important rules that govern a QDRO. These include:

- specifying how much and in what form payments will be made;

- defining who is eligible to receive payments;

- setting out when payments will begin and end;

- determining if or when payments can be terminated;

- establishing whether the order can be modified or amended at a later date.

Are QDROs necessary for all divorce cases?

No, QDROs are typically only required when dividing retirement accounts considered marital property. A QDRO may not be necessary if there are no retirement assets to divide or if both spouses have separate retirement accounts.

Is a QDRO retroactive?

Yes, a QDRO can be issued retroactively, meaning it can take effect prior to the date of issuance. However, this should only be done in appropriate circumstances and with the guidance of an experienced attorney or financial advisor.

In the Walles v. Walles case in 1996, the New Jersey Appellate Division determined that a Qualified Domestic Relations Order (QDRO) could be used as a means to access and redistribute an obligor’s retirement savings in order to satisfy overdue child support or alimony payments. This decision has provided a clear-cut method for enforcing payment of such arrears.

Who prepares a QDRO?

QDROs are often prepared by an attorney specializing in family law or a pension expert with experience drafting these orders. It is crucial to consult with a professional well-versed in the specific regulations and requirements of QDROs to ensure accuracy and compliance.

What is a QDRO processing fee?

A QDRO processing fee is charged by the plan administrator for preparing and validating the QDRO. The amount of the fee may vary depending on the size and complexity of the retirement account.

How long does it take for a QDRO to be completed?

It typically takes between two and six weeks for a completed QDRO to be distributed. During this time, both parties must agree to all terms of the order and sign off on it before it can be processed.

What is the 59 1 2 rule?

The 59 1/2 rule states that individuals can take qualified distributions from their retirement accounts without incurring early withdrawal penalties after they reach the age of 59 1/2. However, distributions taken prior to this age are normally subject to a 10% penalty on top of regular taxes due.

Can a QDRO be modified or revoked?

Once a QDRO is approved by the court and implemented, it is generally difficult to modify or revoke. However, certain circumstances may allow for modifications, such as changes in the retirement plan’s terms or the death of one of the parties involved.

How long does it take to finalize a QDRO?

The timeline for finalizing a QDRO can vary depending on the complexity of the case, the cooperation of all parties involved, and the specific requirements of the retirement plan administrator. Starting the QDRO process as early as possible is important to avoid unnecessary delays.

Can a QDRO be used to collect child support or alimony payments?

No, a QDRO is solely focused on dividing retirement assets. Child support and alimony payments are separate legal matters that are typically addressed through different court orders or agreements.

Do QDROs apply to all types of retirement plans?

QDROs generally apply to most employer-sponsored retirement plans, including pensions, 401(k) plans, and 403(b) plans. However, certain retirement accounts, such as Individual Retirement Accounts (IRAs), may not require a QDRO for division.

What happens if a QDRO is never filed?

If a QDRO is not filed, it is likely that the divorcing spouse will not be able to access any funds from the retirement account. Without a QDRO, the other spouse retains sole ownership of the account and is allowed to make any decisions regarding its distribution.

Who pays the income tax on a QDRO?

Generally speaking, the person receiving funds from a QDRO is responsible for paying any applicable taxes due upon receipt of those funds. It is important to check with an experienced tax professional about specific taxation rules prior to making any distributions from a retirement account in order to ensure compliance with IRS regulations.

Can I empty my 401K before divorce?

No, withdrawing funds from your 401K before the divorce has been finalized is usually not allowed. Additionally, doing so may make it more difficult for an accurate division of marital assets during the divorce process.

What is the penalty for using a QDRO?

There are no penalties associated with filing or using a QDRO; however, failure to comply with IRS regulations when making distributions can result in significant fines or other penalties.

Final thoughts

Divorce and retirement are significant milestones that can have long-lasting financial implications. A QDRO lawyer specializes in Qualified Domestic Relations Orders, which involves dividing retirement assets during divorce proceedings. Their expertise in this area ensures that retirement accounts are properly valued, divided, and distributed according to the applicable laws and regulations.

We hope this blog post sheds light on the importance of having a QDRO attorney when navigating divorce and retirement. Divorce can be challenging and emotional, especially when dividing retirement assets. A QDRO attorney can provide the expertise and guidance needed to ensure a fair and smooth distribution of retirement benefits. By understanding the complexities of a QDRO, you can protect your financial future and make informed decisions during this difficult time. Remember, having the right legal support is crucial, and a QDRO attorney can be your advocate throughout the process.