Deceased Spouse’s Bank Account: Who Inherits the Funds?

Contents

- Deceased Spouse’s Bank Account: Who Inherits the Funds?

- Overview of Inheritance Laws and Regulations

- Joint Accounts with Right of Survivorship

- Beneficiary Designations

- Estate Planning

- Probate Process

- Community vs. Separate Property in Inheritance

- What happens if there is no will or beneficiary designation?

- Tax Consequences of Inheriting a Spouse’s Bank Account

- Related FAQs

- How do I claim my deceased husband’s bank account?

- Does a joint bank account automatically go to the survivor?

- Do bank accounts require a beneficiary?

- Does a will override a beneficiary on a bank account?

- Can you still withdraw money from a joint account if one person dies?

- Can you leave a deceased person’s name on a joint account?

- What happens if no beneficiary is named on bank account?

- What happens if you don’t have a beneficiary on your account?

- How do I access the bank account of a deceased person?

- Can I still access my husband’s joint account if he dies?

- Do joint bank accounts get frozen when someone dies?

- Can I deposit my deceased husband’s check into our joint account?

- Do banks close deceased accounts?

- Conclusion

Losing a spouse is an incredibly difficult and emotional experience, and amidst the grieving process, there are numerous practical and legal matters that need to be addressed. One of the most complex and confusing aspects for many individuals is navigating the intricacies of inheriting a deceased spouse’s bank account.

This blog post aims to provide clarity and guidance on the complexities of inheriting a deceased spouse’s bank account. We will explore:

- the legal framework surrounding inheritance

- the role of beneficiaries

- the necessary documentation

- potential challenges that may arise

By gaining a comprehensive understanding of these factors, you will be better prepared to navigate the process and make informed decisions regarding the funds left behind by your beloved spouse.

Overview of Inheritance Laws and Regulations

When it comes to navigating the complexities of a deceased spouse’s bank account, understanding the legal framework is crucial. Inheritance laws and regulations vary from country to country, and even within different jurisdictions within a country. It is essential to familiarize yourself with the specific laws applicable in your situation.

In general, inheritance laws dictate how a deceased person’s assets, including bank accounts, are distributed among their heirs. These laws determine who has the right to inherit the funds and in what proportion. The legal framework typically considers factors such as marital status, the presence of a will or testament, and the existence of any legal agreements or contracts.

In Texas, when a person dies without leaving a will, the distribution of their estate is governed by intestate succession laws. These laws specify that:

- spouses inherit first

- followed by children

- then parents and siblings of the decedent

Stepchildren do not automatically receive a share unless they were adopted legally by the decedent. Grandchildren only inherit in situations when the children of the decedent are no longer alive to claim their rightful share of an inheritance.

In some jurisdictions, laws may grant the surviving spouse automatic rights to a portion or all of the deceased spouse’s bank account, especially in the absence of a will. This is known as the law of intestate succession Tex. Est. Code § 121.102. However, it is important to note that laws differ, and the surviving spouse may not always have an automatic right to the funds.

In cases where a will exists, the provisions outlined in the document will typically dictate how the bank account funds are to be distributed. The will may designate the surviving spouse as the sole beneficiary or may specify the distribution of assets among multiple beneficiaries, such as children or other family members.

In situations where there is no clear legal framework or conflicting claims to the funds, legal advice should be sought. Consulting with an attorney specializing in estate planning and inheritance laws can provide valuable guidance in understanding and navigating the specific legal requirements and complexities involved.

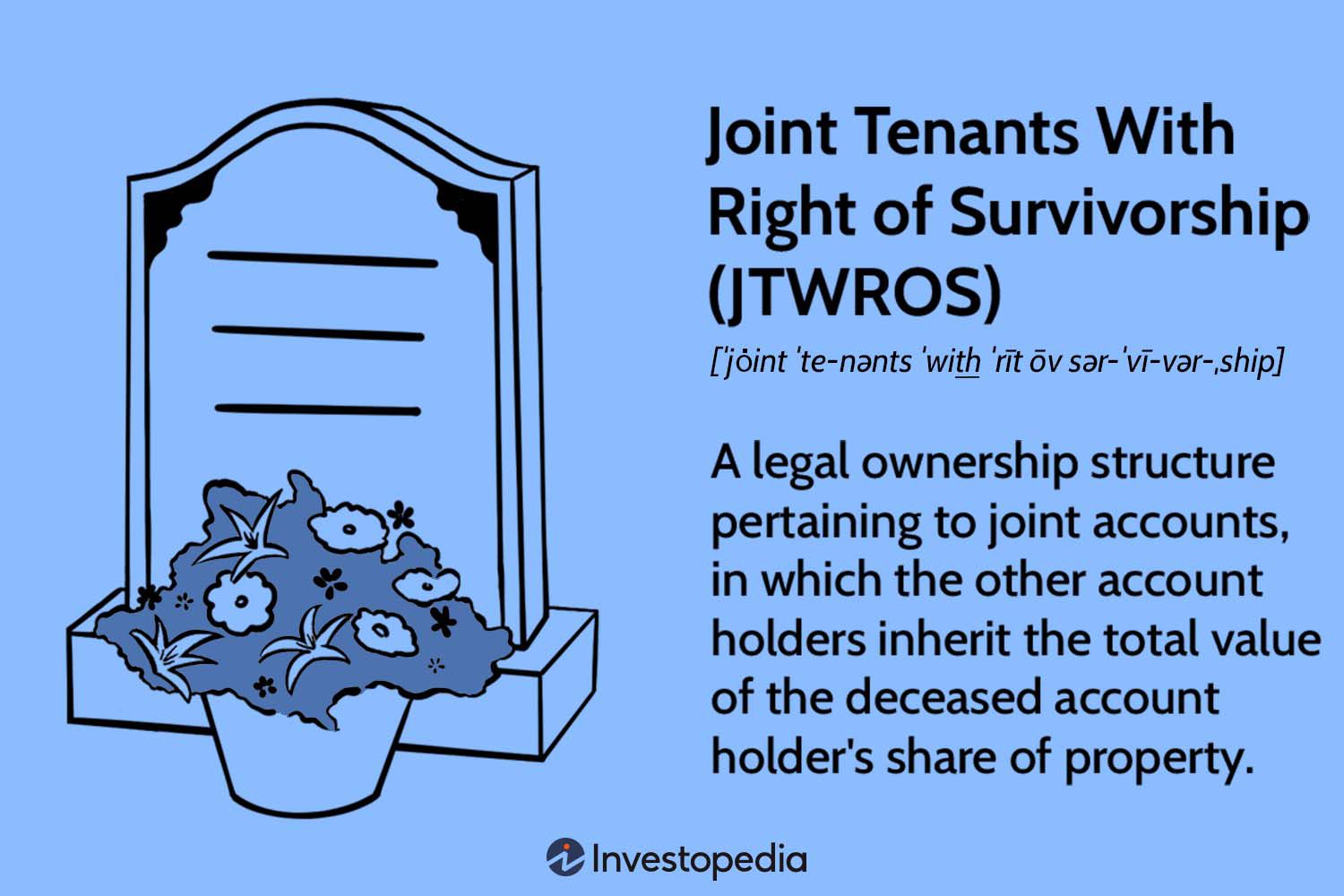

Joint Accounts with Right of Survivorship

Joint accounts can offer a sense of financial security and convenience for couples, but when one spouse passes away, it’s crucial to understand the implications and complexities surrounding these accounts.

In the event of a deceased spouse, the surviving spouse typically becomes the sole owner of the joint account. This means that they have the legal right to access and manage the funds. However, it’s important to note that joint accounts can have different variations and legal arrangements depending on the jurisdiction and specific circumstances.

In some cases, joint accounts may be established as “joint tenants with rights of survivorship” (JTWROS). Under this arrangement, when one spouse passes away, the ownership of the account automatically transfers to the surviving spouse without the need for probate or legal proceedings. This can provide immediate access to funds for the surviving spouse during a challenging time.

On the other hand, joint accounts can also be set up as “tenants in common” (TIC), where each spouse has a distinct share of the funds. In this scenario, when one spouse passes away, their share of the account is typically inherited by their beneficiaries or according to their will. The surviving spouse may still retain their portion of the joint account.

Beneficiary Designations

When it comes to navigating the complexities of a deceased spouse’s bank account, understanding the importance of beneficiary designations is crucial. Beneficiary designations are a vital aspect of estate planning and can greatly impact who inherits the funds in question.

In many cases, individuals have the option to designate a beneficiary on their bank accounts. This designation allows them to specify who will receive the funds upon their passing. It is essential to review and update these designations regularly, especially in the event of major life changes such as marriage, divorce, or the birth of children. Failing to do so can lead to unintended consequences and disputes over the rightful ownership of the funds.

By designating a beneficiary on a bank account, you can ensure that the funds are transferred directly to the intended recipient without the need for probate. This streamlined process can save both time and money for your loved ones during an already difficult time.

However, beneficiary designations override any instructions in a will or trust. Even if a will specifies a different beneficiary, the designation on the bank account will dictate who receives the funds. Therefore, it is crucial to review all beneficiary designations and ensure they align with your wishes and overall estate plan.

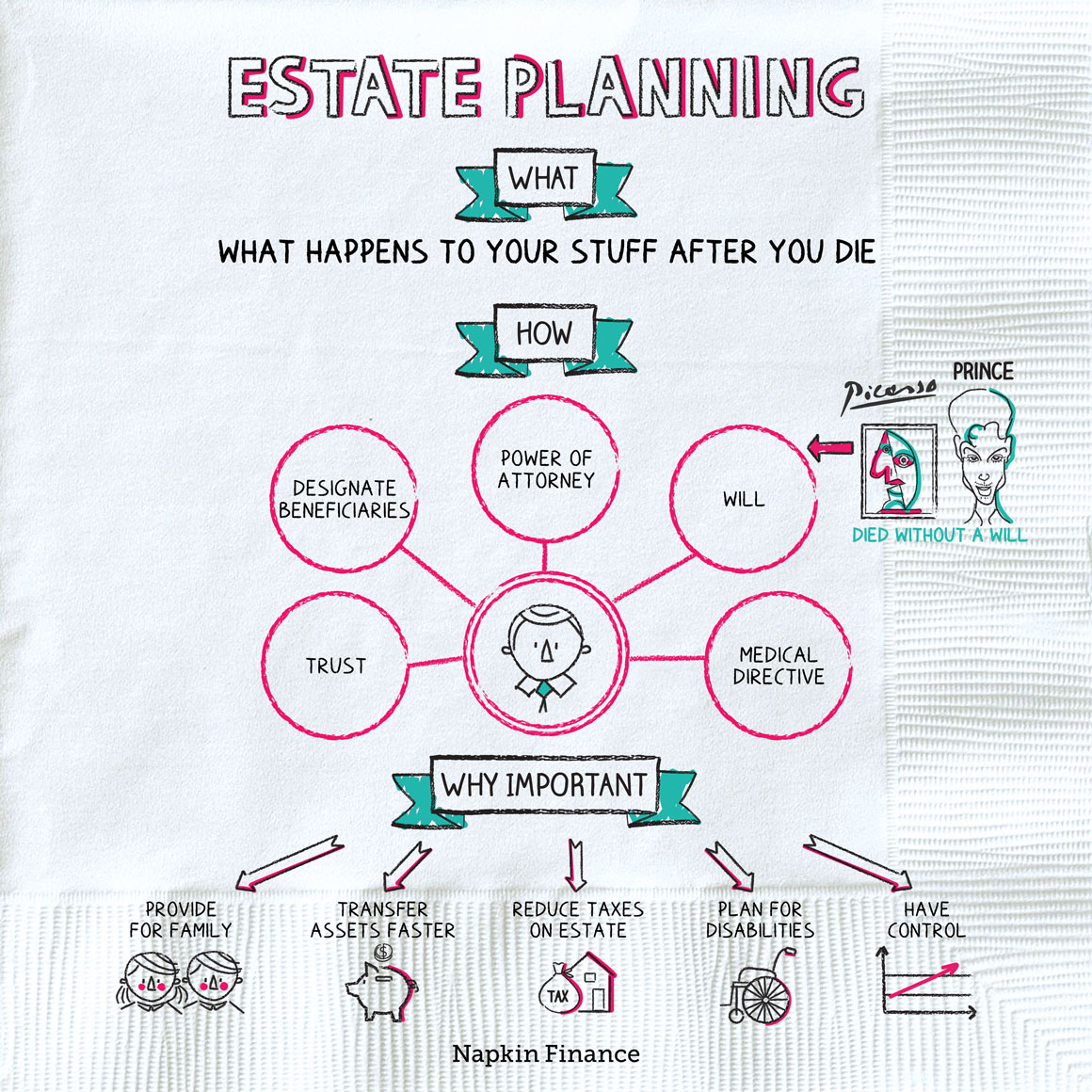

Estate Planning

Estate planning is a crucial aspect of managing your finances and assets, especially when it comes to the complexities of a deceased spouse’s bank account. By engaging in proper estate planning, you can greatly simplify the process for your loved ones and ensure that your wishes are carried out smoothly.

One of the key components of estate planning is creating a will. This legal document allows you to specify how your assets, including bank accounts, should be distributed upon your passing. By clearly outlining your intentions, you can eliminate any ambiguity or potential disputes among your heirs.

In addition to a will, establishing a trust can also be beneficial. A trust allows you to transfer ownership of your assets, including bank accounts, to a designated trustee who will manage them on behalf of your beneficiaries. This can provide added protection and control, as well as potentially bypass the probate process, which can be time-consuming and costly.

Another important consideration in estate planning is designating beneficiaries for your bank accounts. Many financial institutions offer the option to name beneficiaries for various accounts, such as savings, checking, or investment accounts. By doing so, you can ensure that the funds in these accounts are directly inherited by the designated individuals, bypassing the probate process altogether.

It’s important to regularly review and update your estate plan to reflect any changes in your financial situation or personal circumstances. Life events such as marriage, divorce, or the birth of a child can significantly impact your estate plan. By staying proactive and keeping your plan up to date, you can ensure that your wishes are accurately reflected and your loved ones are taken care of.

Consulting with an experienced estate planning attorney is highly recommended to navigate the complexities of estate planning and ensure that your spouse’s bank account and other assets are distributed according to your wishes. They can provide personalized guidance and help you develop a comprehensive plan that meets your unique needs and goals.

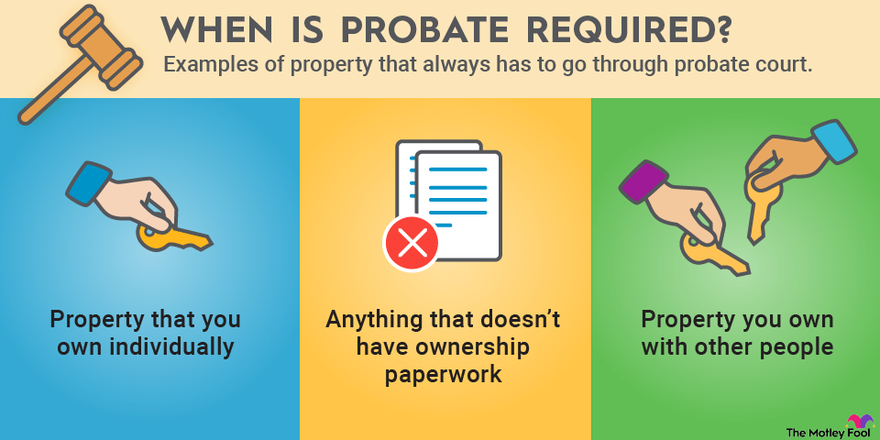

Probate Process

Navigating the probate process for bank accounts can be a complex and daunting task for anyone dealing with the loss of a spouse. Probate refers to the legal process of validating a deceased person’s will and distributing their assets and debts according to the law.

When it comes to bank accounts, the probate process usually involves determining who inherits the funds and ensuring a smooth transfer of ownership. The first step is to notify the bank about the account holder’s death and provide them with the necessary documentation, such as a death certificate and a copy of the will.

In some cases, if the account was held jointly with the spouse, the surviving spouse may automatically become the sole owner of the account. This is known as the right of survivorship, where the surviving spouse inherits the funds without the need for probate.

However, if the account was solely in the deceased spouse’s name or if there are multiple beneficiaries named in the will, the probate process becomes more important. The court will review the will, appoint an executor or personal representative, and oversee the distribution of assets, including the funds in the bank account.

Community vs. Separate Property in Inheritance

When it comes to navigating the complexities of a deceased spouse’s bank account, understanding the distinction between community property and separate property is crucial. In many jurisdictions, the default rule is that any property acquired during a marriage is considered community property, which means that both spouses have an equal interest in it.

However, there are exceptions to this general rule. Separate property is typically defined as assets that were acquired by one spouse before the marriage, received as a gift or inheritance during the marriage, or acquired using separate funds. These assets are not subject to division upon the death of a spouse and are instead inherited by the surviving spouse or designated beneficiaries.

Differentiating between community property and separate property can be challenging, as it often requires a detailed analysis of the facts and circumstances surrounding the acquisition of the assets. It is important to consult with an experienced attorney or financial advisor who specializes in estate planning and inheritance laws to ensure that you understand your rights and obligations.

In some cases, the deceased spouse may have left a will or a trust that specifically addresses the distribution of their assets. This can provide clarity and guidance in determining who inherits the funds from the bank account. However, if there is no will or trust in place, the laws of intestate succession will govern the distribution of the assets, which can vary depending on the jurisdiction.

What happens if there is no will or beneficiary designation?

Intestate succession is the legal term used to describe the distribution of assets when someone passes away without a will. In these situations, state laws step in to determine how the deceased’s estate will be divided among their surviving family members.

The laws governing intestate succession vary from state to state, but they generally prioritize immediate family members as the rightful inheritors. Typically, the surviving spouse and children are given priority in the distribution of assets. If the deceased had no children, the spouse may inherit the entire estate. However, if there are children involved, the estate may be divided between the spouse and the children.

It’s important to note that intestate succession laws can become more complex if there are blended families or if the deceased had children from a previous relationship. In such cases, the distribution of assets may be divided among the surviving spouse, children, and potentially stepchildren.

Tax Consequences of Inheriting a Spouse’s Bank Account

In most cases, inheriting funds from a spouse’s bank account is not subject to federal income tax. The Internal Revenue Service (IRS) considers bequests and inheritances as nontaxable events. Therefore, you generally won’t owe any income tax on the funds you receive from your deceased spouse’s account.

However, it’s crucial to be aware of any interest or investment income that may have accumulated in the account. This income could be subject to taxation. For instance, if the bank account generated interest income during your spouse’s lifetime, that interest may be taxable to you as the beneficiary. It’s important to consult with a tax professional to understand the specific tax obligations associated with any interest or investment income.

Additionally, if the funds inherited exceed a certain threshold, such as the estate tax exemption amount set by the IRS, you may need to evaluate potential estate tax implications. While most estates are not subject to federal estate tax due to the high exemption amount, it’s important to consider any state-specific estate tax laws that may apply.

How do I claim my deceased husband’s bank account?

To claim your deceased husband’s bank account, you will need to provide the bank with a certified copy of his death certificate and proof of your identity. The bank may also require other documents such as an original or notarized will, letters testamentary, or proof that you are the executor/administrator of the estate. Once these documents have been verified, the bank can transfer the funds to you.

Does a joint bank account automatically go to the survivor?

Generally, the surviving spouse is the primary beneficiary of a joint bank account and will inherit any remaining balance. However, if the deceased spouse has named someone else as a beneficiary on the account, then ownership will pass to them instead. It is important to check the terms of the account and review any applicable beneficiary designations.

Do bank accounts require a beneficiary?

In most cases, bank accounts do not require a beneficiary designation. If a beneficiary is not listed, then the ownership of the account will usually default to the surviving spouse or registered domestic partner per applicable state laws.

Does a will override a beneficiary on a bank account?

No, a will does not take precedence over a designated beneficiary on a bank account. Even if the decedent names someone in their will as a beneficiary for their bank account, the account will not be transferred to them unless they are also listed as the primary beneficiary on the account.

Can you still withdraw money from a joint account if one person dies?

Yes, it is possible to withdraw money from a joint account after one owner has passed away. The surviving owner can continue to access and manage the account until it is properly closed.

Can you leave a deceased person’s name on a joint account?

No, the deceased party must be removed from the joint account. All withdrawals and deposits must now be made by the surviving owner only.

What happens if no beneficiary is named on bank account?

If there is no listed beneficiary on a bank account, then ownership of the funds usually defaults to the surviving spouse or registered domestic partner per applicable state laws. The bank may also require additional documents such as an original or notarized will or letters of testamentary depending on the situation.

What happens if you don’t have a beneficiary on your account?

If no beneficiary is listed on your account, then ownership of the funds usually will default to the surviving spouse or registered domestic partner per applicable state laws. The bank may also require additional documents such as an original or notarized will or letters testamentary depending on the situation.

How do I access the bank account of a deceased person?

You will need to provide the bank with a certified copy of their death certificate and proof of your identity. The bank may also require other documents such as an original or notarized will, letters testamentary, or proof that you are the executor/administrator of the estate. Once these documents have been verified, the bank can transfer the funds to you and open up access to the account.

Can I still access my husband’s joint account if he dies?

Yes, it is possible to access and manage your husband’s joint account after he has passed away. The surviving spouse can continue to access and manage the account until it is properly closed.

Do joint bank accounts get frozen when someone dies?

Generally, no. Joint accounts typically remain active after one owner has passed away and can be accessed and managed by the surviving owner until it is properly closed.

Can I deposit my deceased husband’s check into our joint account?

Yes, it is possible to deposit checks belonging to a deceased person into their joint account. The surviving owner can continue to access and manage the account until it is properly closed.

Do banks close deceased accounts?

Banks typically close accounts belonging to deceased persons after proper documentation is provided by family members or legal representatives. After closure, banks typically send any remaining funds in an account to beneficiaries designated by law or those designated by the decedent themselves.

Conclusion

We hope you found our blog post on navigating the complexities of a deceased spouse’s bank account helpful. The loss of a spouse is already a difficult time, and dealing with financial matters can add further stress. Understanding who inherits the funds in a deceased spouse’s bank account is crucial for financial planning and ensuring a smooth transition.

While the laws surrounding inheritance can be complex, we provided valuable insights and considerations to help you make informed decisions. Remember to consult with legal professionals for personalized advice based on your specific circumstances. Our thoughts are with you during this challenging time, and we hope this article has provided some clarity and guidance.