Per Stirpes vs. Per Capita Distributions

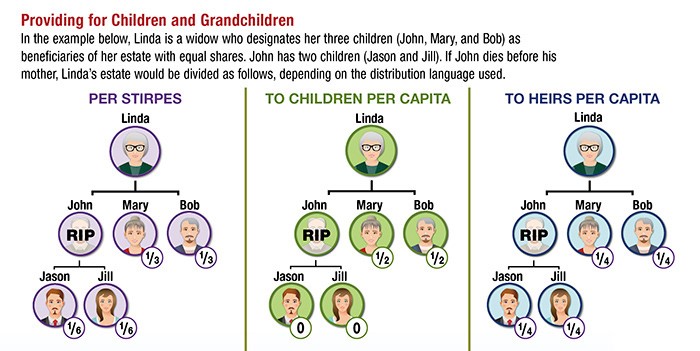

While Latin may be a dead language, it remains relevant to estate planning lawyers and their clients when choosing how to prepare for the distribution of an estate through a will or living trust. “Per Stirpes” literally means “by roots or stocks; by representation” and is used interchangeably with “right of representation” by estate planning attorneys when referring to a particular method for distributing assets of a decedent. An estate is distributed per stirpes if each “branch” of a family is to receive an equal share of the estate assets.

Another common method for distributing assets is referred to as “per capita”. Using ther method, each member of the same generation of a decedent will receive an equal share of the decedent’s estate.

Examples of Per Stirpes and Per Capita Distributions

A good way to illustrate the differences between these two types of distribution methods is by providing examples of each.

Per Stirpes Example #1:

The decedent “A”, specifies in her living trust that her estate is to be divided among her descendants in equal shares per stirpes. A has three children, B, C, and D. B is already dead, but has left two children (grandchildren of A), B1 and B2. Pursuant to a distribution per stirpes, the living children of the decedent, C and D each receive one-third of the estate, and B1 and B2 each receive one-sixth (B’s 1/3rd share). B1 and B2 constitute one “branch” of the family and collectively receive a share equal to the shares received by branches C and D.

Per Stirpes Example #2:

Assume the same facts as Example #1 except grandchild B1 has predeceased A, leaving two children B1a and B1b, and grandchild B2 has also died leaving three children B2a, B2b and B2c. In this case, distribution per stirpes would result in a distribution of one-third each to C and D, one-twelfth each to B1a and B1b, who would constitute a branch, and one-eighteenth each to B2a, B2b and B2c, which again totals B’s one-third share. Thus, the B, C, and D branches receive equal shares of the whole estate, the B1 and B2 branches receive equal shares of the B branch’s share, B1a and B1b receive equal shares of the B1branch’s share, and B2a, B2b and B2c receive equal shares of the B2 branch’s share.

Per Capita Example #1:

Assume the same facts as in the Per Stirpes Example #1. Under the per capita method of distributing the estate, since children C and D survive, the estate is divided at their generations. There were three children, so each surviving child receives one-third. The remainder – B ’s share – is then divided in the same manner among B ’s surviving descendants. The result is the same as under per stirpes because B ’s one-third is distributed to B1 and B2 (one-sixth to each).

Per Capita Example #2:

However, the per capita and per stirpes results differ if D also pre-deceased A with one child, D1. Under the per stirpes method, B1 and B2 would each receive one-sixth (half of B ’s one-third share), and D1 would receive one-third (all of D ’s one-third share). Under per capita, the two-thirds remaining after C ‘s one-third share was distributed would be divided equally among all three children of B and D. Each grandchild would therefore receive two-ninths: B1, B2, and D1 would all receive two-ninths.

Summary

As you can see through these examples, the per capita distribution method is generally more generous to grandchildren of larger families. In other words, where a decedent has more than one child and one or more of the decedent’s children has more children (grandchildren of the decedent) than his or her siblings, those grandchildren of the larger family typically stand to receive a larger share of the decedent’s estate than under the per stirpes method of distribution. On the other hand, grandchildren of smaller families tend to receive less, since some of the share which they might receive under the per stirpes method is divided among the other beneficiaries of their generation.

Depending on the state, there are many variations in these types of distribution methods. Choosing per stirpes or per capita, or another method for dividing assets of your estate is but one of many important issues that must be considered by estate planning lawyers and clients when preparing wills and trusts since these choices can have long-term consequences for families.

FAQs on Per Stirpes vs Per Capita

What is an example of per capita and per stirpes?

Per capita and per stirpes are both methods of distributing assets among heirs. In a per capita distribution, all the shares are divided equally among the heirs. For example, if there are five children in the family, each would receive one-fifth of the assets. In a per stirpes distribution, the heirs are grouped by generation and each group receives a share. For example, if there are two children in the first generation, they would each receive one-half of the assets. If there were also four grandchildren in the second generation, they would each receive one-eighth of the assets.

What is the difference between per stirpes and per capita succession?

In a per capita succession, all inheritors receive equal shares, regardless of generation. In a per stirpes succession, the heirs are grouped by generation with the share distributed accordingly. This means that if more generations are included in the inheritance, later generations may receive smaller shares.

What is the downside of per stirpes?

The downside to using per stirpes as a method for distributing assets is that later generations may receive proportionally smaller shares than earlier generations. This can be a problem if earlier generations have large families and later generations have fewer members.

Is per stirpes a good idea?

It depends on your particular situation. If you want all of your heirs to receive equal shares regardless of their generation, then per capita is likely the better choice. However, if you want to ensure that each generation receives its own designated share, then per stirpes may be preferable.

Does per stirpes include a wife?

Yes, if an individual’s spouse is noted as an heir in the will, then they would be included in the distribution according to the terms specified in the will (whether it be per capita or per stirpes).

Does per stirpes include grandchildren?

Yes, under a per stirpes distribution, grandchildren would generally receive their own separate share of the assets.

What happens if there are no descendants of per stirpes?

In this case, the assets would generally be distributed according to whatever instructions were left in the will. If no instructions were provided, then the assets would typically be distributed according to the laws of intestate succession in your state.

Does per stirpes include siblings?

Yes, if siblings are named in the will as an heir then they would generally receive their own separate share based on the provisions specified in the will (whether it be per capita or per stirpes).

What happens if a per stirpes beneficiary dies?

If a beneficiary dies before receiving their share, then their portion would typically be divided among their children. If there are no living children, then their share would generally be given to their surviving siblings or other surviving relatives designated in the will.

How many generations does per stirpes cover?

It typically covers all generations of heirs specified in the will.

Does per stirpes mean equal distribution?

No, not necessarily. Under per stirpes, each generation receives its own separate share which may result in unequal distribution among generations depending on how many heirs exist within each generation.

How do you use per capita in a will?

In order to use per capita in a will, you must specifically designate it as such in your instructions for asset distribution. This should include naming all of your heirs and specifying what percentage or fractional share each heir should receive.