Rebuild Your Credit to 750 After Bankruptcy

One of the biggest questions when considering bankruptcy is how it will affect your credit score, particularly if it’s a 750. You can recover your 750 credit score if or when you file for bankruptcy.

In the immediate aftermath of filing for bankruptcy, your credit score will likely drop significantly due to the black mark that is associated with the process. In the long run, there are various measures you can take to continue increasing your score. With some diligence and commitment, you can regain your 750 credit rating after declaring bankruptcy.

It’s important to first understand how your bankruptcy affected your credit score both in the short- and long-term. You can and should take several steps to recover your 750 credit score after you’ve filed for bankruptcy.

What will a 750 credit score get me?

- Lower Interest Rates: With a credit score of 750, you’re likely to qualify for lower interest rates on loans and credit cards. This can save you a significant amount of money over time, especially on large loans like mortgages and auto loans.

- Higher Approval Odds: Lenders are more likely to approve your credit applications, including for credit cards, personal loans, and mortgages when you have a credit score of 750 or higher.

- Better Credit Card Offers: You may receive offers for credit cards with attractive rewards programs, cashback incentives, and lower annual fees. Some premium credit cards with exclusive benefits may become accessible to you.

- Favorable Mortgage Terms: When buying a home, a credit score of 750 can help you secure a mortgage with favorable terms, such as a lower down payment requirement and a lower interest rate.

Effects of Chapter 7 on Your Credit Score

The big difference between Chapter 13 and Chapter 7 Bankruptcy plans is that with Chapter 7, you and your bankruptcy attorney are not required to propose a repayment plan. You are not required to pay back your creditors, but you may be required to surrender any non-exempt property to the bankruptcy court. Exempt property can include jewelry (depending on the value), clothes, household items, etc. Non-exempt property can then be sold, and the money will be dispersed to creditors.

Effects of Chapter 11 on Your Credit Score

Chapter 11 Bankruptcy is typically a business route, but you can also use it. Chapters 7 and 13 are cheaper and quicker forms of bankruptcy, but Chapter 11 usually involves larger sums of money. It allows you to reorganize your debt, and a bankruptcy attorney can help you determine if this option is best for you.

This form of bankruptcy sets up a plan whereby the creditors aren’t able to take action against the company or individual while that person or organization develops a reorganization plan. That plan includes how the company will operate and how the debt will be repaid. It also can include carefully laid out details about how the company will reduce assets and expenses to remain viable. Chapter 11 Bankruptcy still affects your credit score, though it may not affect your score as much as Chapter 13 or Chapter 7.

What is a Credit Score?

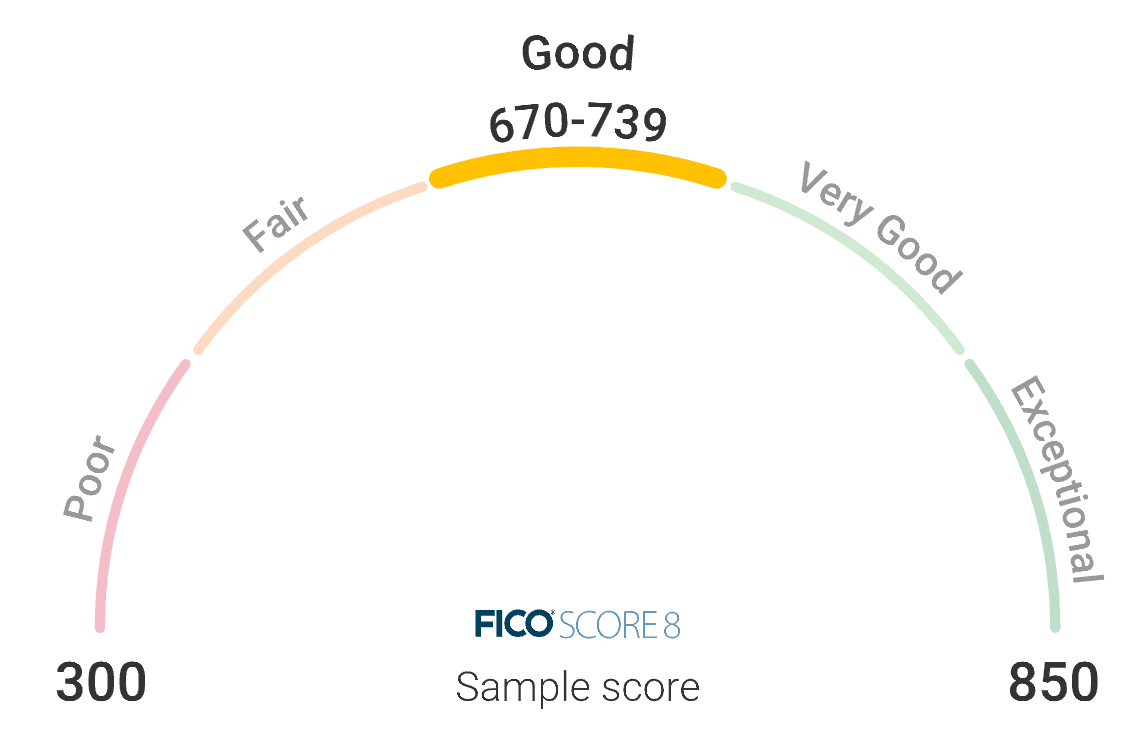

Your Credit Score is just a statistical number that considers various factors in your credit history and reporting details to determine how financially viable or responsible you’ve been. It can include your lines of credit, payment of bills, length of credit, outstanding loans, and other factors when it associates a three-digit number with your name and social security number. The number usually ranges from 300 to 850. There are many scoring models, and each one can consider different variables.

The general concept is that you are a lower-risk investment if you have a good credit score. So, with a higher credit score, lenders and creditors may be more likely to offer you credit cards, loans, etc. With a poor credit score, those same financial institutions will decline your loan, or they may charge a higher interest rate on your loan since you’re a higher risk. Your credit score can affect your ability to buy a house, a car, etc. For various reasons, it’s important to ensure you maintain a good credit score.

Check Your Credit Score

The first step in rebuilding your credit is understanding how your bankruptcy has affected your credit score. How low has the score plummeted? Besides the bankruptcy, what other factors are affecting your credit score? Are there errors in your credit report making your credit score lower than it should be? It would be best if you worked to correct any errors immediately.

While it may take time to correct your credit report, it can also make the biggest difference in your credit report both now and in the future. With your correct credit report, those details are just a roadmap to help you determine the best path to recover your 740 credit score.

Where to Check Your Credit Score?

You can check your credit score through various sources, including credit bureaus, financial institutions, and online services. Here are some common places where you can check your credit score:

- AnnualCreditReport.com: This website is authorized by the U.S. government to provide consumers with one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. While it doesn’t provide your credit score for free, you can review your credit reports for accuracy and identify any discrepancies.

- Credit Bureaus: You can request your credit score directly from the three major credit bureaus:

- Equifax: Visit Equifax’s website or call 1-800-685-1111.

- Experian: Visit Experian’s website or call 1-888-397-3742.

- TransUnion: Visit TransUnion’s website or call 1-800-888-4213.

- Credit Card Issuers: Some credit card issuers offer free access to your credit score as a cardholder benefit. Check with your credit card company to see if they provide this service.

- Credit Monitoring Services: There are several paid credit monitoring services, such as myFICO, Credit Karma, and Credit Sesame, that offer free access to your credit score and credit reports. These services often provide ongoing monitoring and alerts for changes in your credit profile.

- Banks and Credit Unions: Many financial institutions provide customers with access to their credit scores through online banking portals or mobile apps. Check with your bank or credit union to see if they offer this feature.

- FICO Score: You can purchase your FICO credit score, which is widely used by lenders, directly from the official FICO website (myFICO.com). FICO scores are often used in lending decisions.

- Credit Score Apps: There are numerous mobile apps available that allow you to check your credit score for free. Some of them also provide credit monitoring and educational resources to help you manage your credit.

- Credit Counseling Agencies: If you’re working with a credit counseling agency to improve your credit, they may provide access to your credit score as part of their services.

Different sources may provide slightly different credit scores because they use different scoring models. However, these variations are generally minor, and the scores should be relatively consistent.

Rebuilding Your Credit

Pay Your Bills on Time

Your current payment history may be one of the factors that are showing up on your credit score. Payment history makes up 35% of your credit score, which may have been why you declared bankruptcy.

You may have been regularly behind on your payments and just didn’t see any way out of your situation. If late payments were a problem in the past, it’s one of the easiest ways to start to turn your credit score around. You can set up automatic payments, set up reminders, or work out other solutions to pay bills on time.

Consider Debt Settlement

Hiring a debt settlement attorney will positively affect your credit score. With a debt settlement, your credit report will indicate a “Settled” or “Paid Settled” status in the creditor update.

A settlement impacts your credit score but combines with other factors. It’s also one way to rebuild your credit to the 740 credit score level. A debt settlement is a great way to demonstrate that you’re working to pay off your debt and rebuild your credit.

Apply for a Loan or Credit Account

As you progress with rebuilding your credit and improving your credit score, you can show that you are responsible for taking out a loan or opening a line of credit. This new account is just another way to demonstrate that you are responsible, that you can prove a history of on-time payments, and that you are dedicated to improving the details on your credit report after your bankruptcy. It’s also a safety net that can help you ensure all your other accounts are paid on time.

If you start with low loan amounts or credit and then pay off your debt promptly and reliably, you may also consider getting a co-signer on a loan or credit account, making it easier to get approval for credit or a loan. A bankruptcy may have been your best option for several reasons, many of which could be outside your control. While your bankruptcy will affect your credit score, it could also be a way to wipe the slate clean.

It would help if you had a way to get back on your feet and reach a healthy financial standing in your life. By carefully avoiding former pitfalls, you can work to gradually rebuild your credit score back up to the 750 level that you had before.

FAQ on Credit Scores after Bankruptcy

How long does it take to get a 700 credit score after Chapter 7?

Establishing a credit score of 700 or higher after filing for Chapter 7 bankruptcy can take several months. After filing, you should establish and build up your credit history, the primary factor determining your credit score. This can include opening secured credit cards, taking out installment loans, and setting up automatic payments. Over time, as you responsibly use and pay off credit, your credit score should gradually rise to the 700 or higher range.

What is the average credit score after Chapter 7?

The average credit score after filing for Chapter 7 bankruptcy is around 520 to 650, depending on the bureau that scored it. Your current debt-to-income ratio, payment history, credit utilization rate, and other factors such as public records and length of credit history will determine your FICO score.

How long does it take to get an 800 credit score after Chapter 7?

It typically takes 6-9 months to reach an 800 credit score after filing for Chapter 7 bankruptcy, although this time frame may vary based on individual circumstances. During this time, it’s important to build strong credit habits, such as paying off debts in full each month and keeping balances below 30% of the total available credit limit.

How to get a 750 credit score after bankruptcies?

Establishing a credit score of 750 or higher after filing for bankruptcy typically requires developing healthy habits related to handling and using credit over time. This can include regularly using and paying off revolving accounts such as credit cards and personal lines of credit responsibly. Additionally, consistent payments toward other accounts in good standing (e.g., student loan debt) will help boost your score over time.

Is it possible to get an 800 credit score after Chapter 7?

Yes, reaching an 800 or higher credit score is possible after filing for Chapter 7 bankruptcy; however, it may take a few months or longer for you to achieve this goal, depending on your financial situation and credit habits. Developing and maintaining positive financial behavior (e.g., paying bills on time) while creating a sound budget are key strategies for improving your credit score quickly and efficiently.

How to get 800 credit score after Chapter 7?

Reaching an 800 or higher credit score after filing for Chapter 7 bankruptcy starts with rebuilding your credit history by establishing new, responsible habits with your existing accounts. You can do this by regularly using and paying off revolving accounts such as credit cards and personal lines of credit responsibly and making consistent payments toward other accounts in good standing (e.g., student loan debt). Additionally, try to keep balances below 30% of the total available credit limit and check your credit report regularly for errors that could be dragging down your score.

How rare is a 750 credit score?

A 750 credit score is fairly common in the U.S., with about 20 percent of those surveyed having scores around this number. It’s generally considered good or excellent if you find yourself in that category or even higher.

Why did my credit score increase after filing Chapter 7?

Filing for Chapter 7 bankruptcy has the potential to improve your credit score over time due to the removal of delinquent accounts from your report following discharge. While not all negative items will be removed, some negative marks may cease to affect your credit once discharged because they are no longer being reported on your report. Additionally, creditors view Chapter 7 filers as having less risk than someone who has had multiple late payments or delinquencies before filing for bankruptcy, so you may also see an improvement in creditworthiness.

What is a 750 credit score worth?

A 750 credit score is generally associated with better terms when obtaining new credit, such as lower interest rates, fewer fees, larger borrowing limits, and more flexible repayment options. It’s also often easier to obtain recreational loans such as mortgages or car loans with a higher credit score since many lenders perceive borrowers with excellent credit as having less risk than those with fair or poor scores.

How bad does Chapter 7 hurt credit?

Filing for Chapter 7 bankruptcy can significantly impact your credit score, potentially lowering it to an average of 140 points or more, according to the FICO scoring model. Your financial situation before filing (e.g., payment history) and post-filing behavior (e.g., timely payments) are contributing factors that determine how much it impacts your overall score.

How long is credit ruined after Chapter 7?

Credit isn’t necessarily ruined forever after filing for Chapter 7 bankruptcy but rather affected for some time before slowly rebuilding back up for months or years through responsible financial management. Depending on circumstances, some may see their scores rise again within two years, whereas others may take longer to achieve their desired results.

How long will Chapter 7 affect my credit score?

The effects of filing for Chapter 7 bankruptcy on your credit can last anywhere from three to seven years, depending on the type of loan products you apply for and other circumstances, such as payment history before and after filing. Additionally, if you choose to make on-time payments on any loans taken out after filing, it can help improve your score faster than if you were simply waiting for seven years.

Recap: Steps to increase your Credit Score

Rebuilding your credit after a Chapter 7 bankruptcy can be a challenging process, but it is possible. Here are steps you can take to work towards increasing your credit score to 750 or higher:

- Understand Your Current Credit Report: Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion). Review your reports to ensure that all discharged debts are marked as “discharged in bankruptcy” and that there are no errors or inaccuracies.

- Create a Budget: Establish a realistic budget to manage your finances. This will help you prioritize debt payments, save money, and avoid accumulating new debt.

- Open a Secured Credit Card: Secured credit cards are a great way to start rebuilding credit. You’ll need to provide a security deposit, which typically becomes your credit limit. Make small, regular purchases and pay the balance in full every month to show responsible credit use.

- Pay Bills on Time: Timely payments are crucial for rebuilding your credit. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Existing Debt: If you have any remaining non-dischargeable debts, such as student loans or certain tax debts, make a plan to pay them off. Reducing existing debt will improve your debt-to-income ratio.

- Become an Authorized User: If you have a trusted friend or family member with a good credit history, ask if they can add you as an authorized user on their credit card account. Their positive payment history can benefit your credit score.

- Apply for a Credit-Builder Loan: Some credit unions and financial institutions offer credit-builder loans. These loans are designed to help you build credit. You make small monthly payments, and once the loan is paid off, you receive the loan amount.

- Diversify Your Credit Mix: Over time, aim to have a mix of different types of credit, such as credit cards, installment loans, and retail accounts. A diverse credit mix can positively impact your credit score.

- Avoid High Credit Utilization: Keep your credit card balances low in relation to your credit limit. High credit utilization can negatively impact your credit score. Aim to use no more than 30% of your available credit.

- Be Patient: Rebuilding credit takes time. It may take several years to see significant improvements in your credit score. Continue practicing responsible credit habits consistently.

- Monitor Your Credit: Regularly monitor your credit reports to ensure accuracy and track your progress. You can access one free credit report from each bureau annually at AnnualCreditReport.com.

- Consider Professional Help: If you’re struggling to rebuild your credit on your own, consider working with a credit counseling agency or a reputable credit repair company. Be cautious and research your options thoroughly.

Remember that while a credit score of 750 or higher is a good goal, it may take time to achieve, especially after a Chapter 7 bankruptcy. Focus on responsible financial habits, and over time, your credit score should gradually improve.