Holiday Pay Laws – Employee Rights by State

Contents

- Holiday Pay Laws – Employee Rights by State

- Employee Holiday Laws in Texas

- Paid Holidays in California

- Paid Holiday Laws in Massachusetts

- Paid Holidays in Maine

- Paid Holiday Laws in New York

- Paid Holidays in Rhode Island

- Paid Holidays in Connecticut

- FAQs about Paid Holiday Laws

- What is the federal rule on holiday pay?

- How many paid federal holidays are there?

- How many paid holidays do most companies give?

- What is the legal definition of a paid holiday?

- Do employees get all federal holidays off?

- What are 11 paid federal holidays?

- Can employers ignore federal holidays?

- Is Juneteenth a paid holiday?

- Does everyone get Juneteenth off?

- What states observe Juneteenth as a paid holiday?

- How many federal holidays are there that honor only one person?

- What happens if a holiday falls on your day off?

- What is an example of holiday pay?

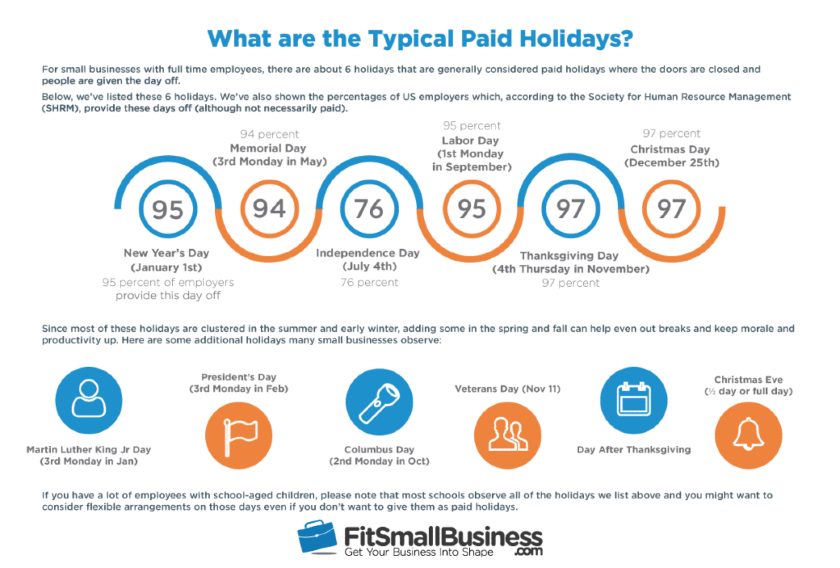

In the United States, a number of holidays are observed offering employees time off with pay. Comprising around 62% of the total population, the labor force is central to many businesses in the country. According to a study by the Society for Human Resource Management (SHRM), 97% of private-sector businesses determine which days their staff will receive paid time off. The most widely observed holidays with paid time off include:

- New Year’s Day

- New Year’s Eve

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving

- the day following Thanksgiving known as Black Friday

- Christmas Eve

- Christmas

Additionally, there are many holidays celebrated at the state and local level offering varying levels of paid leave.

The laws of most states, including Texas, do not mandate employers to provide any paid holidays or time off for employees. However, they may choose to do so depending on the policies outlined in their employment agreements and collective bargaining contracts.

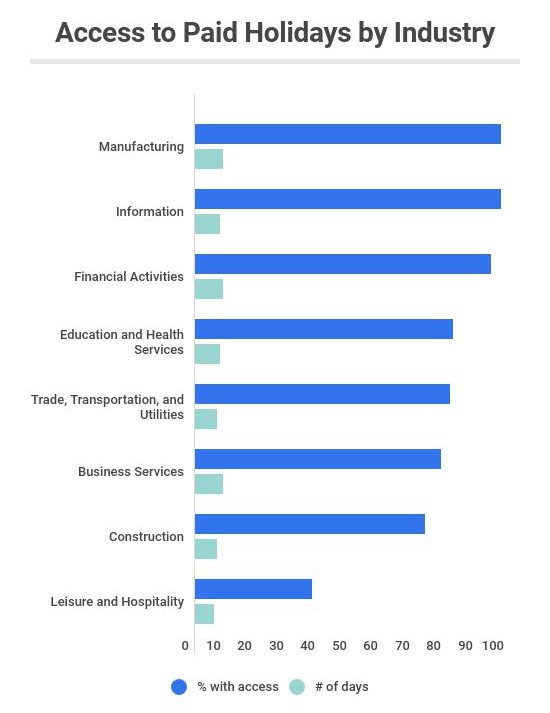

If you’re looking to optimize your work-life balance with generous paid holidays, the manufacturing industry is the way to go. Analysis of various industries has revealed that, due to an above-average number of national and regional holidays as well as company-specific days off, manufacturing jobs can offer some of the best overall paid holiday statistics. On the other hand, the leisure and hospitality industry falls short in terms of providing time away from the office.

Depending on the workplace, additional pay may be given out to compensate for employees taking a holiday, and some employers even offer extra benefits such as an annual bonus or vacation days. Ultimately, it is up to the employer to provide this type of compensation when deciding to observe a particular holiday.

Employee Holiday Laws in Texas

Employees in Texas have limited access to paid and unpaid holidays by law, but many private employers understand the benefit of offering them. Public sector employees are granted 11 legal and paid holidays by federal law, while those working under government contracts may qualify for additional holidays depending on their class of employee.

Private employers are not obligated to provide employees with overtime or bonus pay for working on holidays, but many do so anyway to improve morale. It is advisable for all employers to put holiday policies in place detailing employee privileges when it comes to holidays so that everyone is given equal and fair treatment. Additionally, companies with more than 15 employees are subject to discrimination laws and may need to grant religious holidays to those wishing to celebrate them.

Paid Holidays in California

California has implemented paid holiday laws to ensure that some workers receive adequate rest, allowing them to remain productive and healthy. These regulations afford employees the opportunity to enjoy paid holidays off, including New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day. Employees who do not have a regular work schedule are also eligible for such benefits, provided they have completed at least 15 days of employment in the prior year.

Paid holiday laws in California are designed to protect employees and provide them with fair wages and reasonable working conditions. For instance, employers must provide compensation for any hours missed due to a holiday at an employee’s normal hourly rate. In addition, employers are required to grant employees at least one hour of pay and one hour of vacation time for each day worked on a holiday. To further ensure fair wages, employers may not deduct from the employee’s paycheck any time taken off as part of a holiday.

Paid Holiday Laws in Massachusetts

Massachusetts has a “Blue Laws” statute that requires certain retailers to pay employees extra compensation for working on Sundays and certain holidays.

The Massachusetts Paid Holiday Law guarantees employees at least seven paid holidays per year, such as New Year’s Day, Martin Luther King Day, Patriots’ Day, and the Fourth of July. The law also requires employers to give employees at least 2 weeks’ notice before the holiday so they have time to prepare. Furthermore, it stipulates that employers must pay workers for holidays even if they don’t actually work on them.

Paid Holidays in Maine

Maine has laws that require certain employers to pay employees at least one and a half times their regular rate of pay for working on certain holidays.

According to the Maine Department of Labor, any employer in the state is required to provide eligible employees with paid leave on all state and federal holidays. This includes holidays like New Year’s Day, Memorial Day, Fourth of July, Labor Day, Thanksgiving, and Christmas.

Employers must also provide their employees with at least 24 hours of paid personal leave each year. This leave can be used for religious or cultural purposes as well as for rest and relaxation.

Employees in certain industries may be entitled to additional rights regarding paid holiday leave. For instance, workers who work for a restaurant or bar may be required to take extra days off on New Year’s Eve and/or Christmas Day. Similarly, those employed by a hotel or motel might be required to take extra days off on certain other holidays.

Paid Holiday Laws in New York

In New York, certain employers may be required to provide paid time off or additional pay for employees who work on holidays.

Under New York State’s labor laws, non-retail employees who work more than 6 consecutive hours have the right to receive one hour of paid vacation time for every 30 hours they work. This comes in addition to the unpaid vacation days that are provided by federal law. In addition, New York also requires employers to give their employees a day off on certain holidays unless the employer provides an alternate day off with pay. These holidays include Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, Christmas Day, and New Year’s Day.

For retail workers, the rules are slightly different. Employers do not have to provide retail employees with a paid holiday on any of the holidays noted above as long as those employees remain under 40 hours a week. However, retail employers must provide staff with 11 consecutive hours off per 24-hour period at least once every two weeks. Also, for retail employees, the state requires employers to give employees up to two consecutive days off in seven days if their total hours worked exceed 40 hours in a single workweek.

Paid Holidays in Rhode Island

Rhode Island has laws that require certain retailers to pay employees extra compensation for working on Sundays and certain holidays.

As of January 2021, Rhode Island has adopted paid holiday laws (R.I. Gen. Laws § 25-3-2) that provide employees with many benefits. The law establishes 14 legal holidays each year, including federal holidays, state holidays, and municipal holidays. Any number of these holidays may be combined into a single day off with pay, at the discretion of the employer. Moreover, employers may choose to offer up to two additional days off with pay to their employees.

The paid holiday laws in Rhode Island offer flexibility for both employers and employees. Companies can decide which holidays they will recognize and combine them as needed. They may also opt to add two extra days off with pay to encourage their workforce and boost morale. For employees, having access to 14 or more paid holidays can mean more time spent with family or pursuing leisure activities, without sacrificing their income.

When scheduling paid holidays, it is important to comply with all applicable laws. These include the Fair Labor Standards Act (FLSA), which sets minimum wage and overtime requirements, as well as the Rhode Island Minimum Wage Act. It is also important to ensure that employees will not suffer adverse employment action due to taking a paid holiday.

Paid Holidays in Connecticut

Connecticut has laws that require certain employers to provide employees with paid holidays or holiday pay.

Under Connecticut law, employers must give all full-time and part-time employees one paid holiday for each month of employment. The list of holidays differs depending on the employer, but common choices include Martin Luther King Day, Independence Day, Memorial Day, Labor Day, and Thanksgiving.

For employees who work on a holiday or rotating shifts, Connecticut law allows for additional benefits. “Holiday premium pay” provides compensation for workers when their hours are disrupted by the observance of a holiday. This payment amounts to 1 1/2 times an employee’s regular rate for the hours worked.

These laws do not apply to independent contractors or volunteers working in Connecticut. However, many employers choose to provide voluntary holiday pay as an incentive to attract and retain top talent.

FAQs about Paid Holiday Laws

What is the federal rule on holiday pay?

According to the U.S. Department of Labor, most employers are required to pay their employees for any day off that they observe as a holiday. The employee must be given at least one and one-half times their regular rate of pay for any hours worked on a federal holiday, as well as time and a half for every hour of overtime.

How many paid federal holidays are there?

There are 11 paid federal holidays in the United States, including New Year’s Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, Christmas Day, and others. The dates of these holidays are determined by Congress each year.

How many paid holidays do most companies give?

The number of paid holidays provided by employers varies greatly depending on the company. Generally speaking, most employers provide between 6-10 total paid holidays per year.

What is the legal definition of a paid holiday?

A paid holiday is defined as any day off from work that an employer pays its employees for, whether it is a state or federal holiday. On this day, employees receive either their normal daily wage or an increased rate of pay.

Do employees get all federal holidays off?

While most employers typically provide employees with time off on federal holidays, they are not obligated to do so. Employers may choose to provide additional holiday benefits if they wish, although they are not legally required to do so.

What are 11 paid federal holidays?

The 11 paid federal holidays are New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, Christmas Day, and sometimes Washington’s Birthday.

Can employers ignore federal holidays?

Although employers are not legally obligated to recognize all federal holidays, it is generally considered best practice to do so. Not recognizing these holidays may lead to dissatisfaction from employees.

Is Juneteenth a paid holiday?

28 states recognize Juneteenth as a public holiday. This year, California state employees have the option of taking Juneteenth off in lieu of one of their personal holidays. Similarly, in Pennsylvania, Juneteenth has been declared an “official annual observance” and state employees are granted a paid day off for the occasion. North Carolina has made it possible for certain state workers to choose a floating holiday on a day of cultural, religious, or personal significance, which may include Juneteenth. As such, states have taken steps to recognize and celebrate this important day that commemorates the end of enslavement in the U.S., signifying a major milestone in the advancement of civil rights.

Does everyone get Juneteenth off?

Private employers are not mandated to provide paid time off on holidays, including Juneteenth, to nonexempt employees who are entitled to both applicable minimum wage and overtime compensation. Nevertheless, if companies have binding contracts or arrangements with staff members, they may be obligated to follow them and grant employees the time off requested. It is important for companies to remain informed of their obligations under any relevant contracts or agreements in order to uphold their commitments and ensure that their employees receive the proper leave.

What states observe Juneteenth as a paid holiday?

At the time of writing this FAQ, Arkansas, Florida, Georgia, Iowa, Kentucky, Louisiana, Missouri, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, and Virginia have all passed legislation that recognizes Juneteenth as a paid holiday for state government employees. Other states have also passed statewide legislation that requires private employers to offer their employees either paid or unpaid leave on Juneteenth.

How many federal holidays are there that honor only one person?

There are three federal holidays that honor a single individual – Martin Luther King Jr. Day (honoring Martin Luther King Jr.), Columbus Day (honoring Christopher Columbus), and Washington’s Birthday (honoring George Washington).

What happens if a holiday falls on your day off?

If you normally work on the day when a holiday falls and the holiday is observed by your employer you will likely receive either an alternate workday off or extra pay in lieu of the holiday. If the holiday falls on a day when you are already scheduled off then there may be no change in your work schedule or pay.

What is an example of holiday pay?

An example of holiday pay is when an employee receives 1½ times their regular rate of pay for working on a federal holiday or other designated holiday observed by their employer.