Prenuptial Agreement in California

Contents

- Prenuptial Agreement in California

- Do You Need a Prenuptial Agreement?

- Prenup Benefits

- What Can and Cannot be Included in Prenups

- Premarital Agreement Amendments

- FAQs on California Prenuptial Agreements

- How do I convince my fiancé to sign a prenup?

- Are prenuptial agreements enforceable in California?

- Can I write my own prenup in California?

- What is the 7-day rule for prenups?

- Do both parties need a lawyer for a prenup in California?

- How much does a California prenup cost?

- What invalidates a prenup in California?

- How long do prenups last in California?

- Does a prenup need to be notarized in California?

- How do I get a prenuptial agreement in California without a lawyer?

- What voids a prenup?

- Can cheating nullify a prenup?

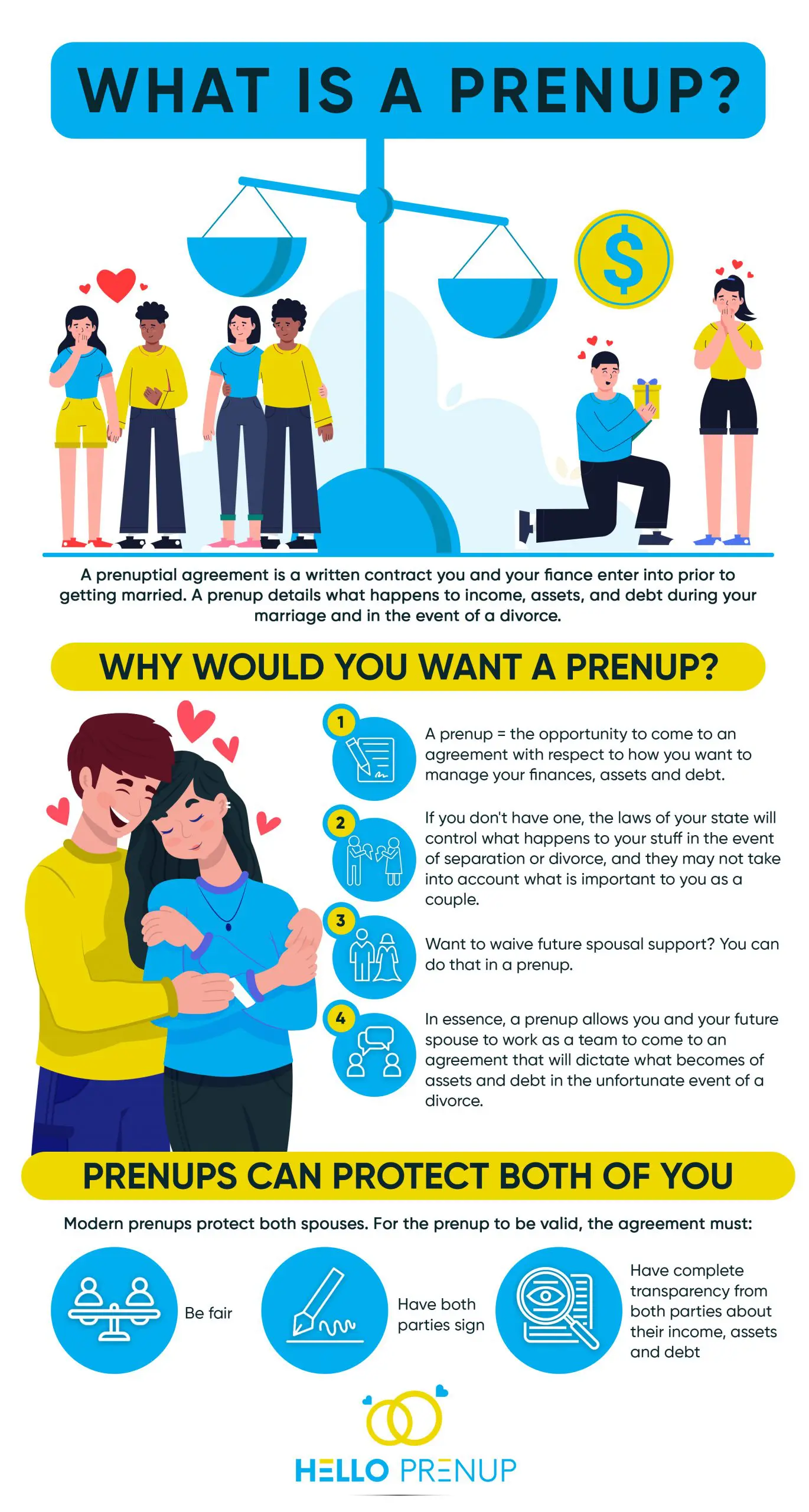

As you prepare for marriage, you are probably thinking about everything but a prenuptial agreement. However, even people in rock-solid relationships sometimes choose to sign a prenuptial agreement or prenup. Every state, including California, has prenup laws. In this guide, we review what you need to know about creating a prenuptial agreement in California.

A prenup isn’t just a “break-up plan”; it’s your personal financial blueprint for your marriage.

In California, the moment you say “I do,” the state’s Family Code essentially acts as your prenup, outlining how assets and debts are managed in your marriage and what changes in the event of a divorce. This means every married couple is already under a “prenup” by default. However, creating your own prenup allows you to customize these financial terms to suit your unique relationship, offering a chance to build a stronger foundation through open communication and mutual understanding.

It’s about deciding together how you’ll handle everything from salaries to savings, not just splitting assets. So, why not take the wheel and drive your financial future together? It’s not just practical; it’s a way to strengthen your bond by fully understanding each other’s perspectives and expectations.

Uniform Premarital Agreement Act

The Uniform Premarital Agreement Act (UPAA) has applied to California prenups since 1986. In general, this law states that written prenuptial agreements signed by both parties, in contemplation of marriage will automatically become effective once the couple marries. An agreement can cover a couple’s present and future property rights, as well as other matters related to the marriage, but it can’t negatively affect a child’s right to child support or take away a court’s power to control child custody and visitation after marriage.

Principles of general contract law also apply to prenuptial agreements. Agreements require valid consent, meaning that a person must have the mental ability to consent, and that consent cannot be the result of fraud, inappropriate influence, or mistake.

Do You Need a Prenuptial Agreement?

Just because you choose to get a prenup does not mean that you think the relationship will end. It simply means that you understand that some things can happen and that you do not want to be unprepared.

| Pros of a California Prenup | Cons of a California Prenup |

|---|---|

| Protects individual assets and specifies debt responsibilities, preventing disputes. | May be seen as mistrustful, potentially straining the relationship. |

| Outlines spousal support terms, offering financial clarity. | Involves legal costs for drafting and consultation. |

| Safeguards inheritance rights, ensuring assets go to intended beneficiaries. | Cannot cover child custody/support, limiting its scope. |

| Reduces conflict and facilitates a smoother divorce process. | Risk of unfairness if not properly balanced, possibly leading to legal challenges. |

Even if your relationship is stable now, you may want to consider getting a prenuptial agreement. Each couple will have different reasons that they want to sign a prenup. People who should consider a prenup are those with assets before marriage, single parents, business owners, grandparents, and business professionals. Additionally, if one or both have debt, they may want to sign a prenup to protect the other in case of their early demise.

If the couple were to divorce in the future, it could be helpful to agree that the two would want to protect each other financially. A prenup can help to prevent extensive court proceedings and promote early and open communication between the couple.

Prenup Benefits

The top 5 benefits of a California prenuptial agreement, as highlighted from the sources, include:

- Asset Protection: A prenup allows individuals to safeguard their separate property, business interests, and other assets they acquired before marriage, ensuring that these remain untouched in the event of a divorce.

- Debt Allocation: This specifies how debts and liabilities will be shared between the parties if the marriage ends, protecting each party from being unfairly burdened by the other’s debts.

- Spousal Support Clarity: The agreement can define terms for spousal support or alimony, including the possibility of waiving it altogether, which provides both parties with financial clarity and expectations.

- Inheritance Rights Protection: Prenuptial agreements can outline how assets will be distributed in the event of one spouse’s death, ensuring that inheritance rights are upheld according to each party’s wishes.

- Conflict Minimization: By setting clear financial expectations and agreements beforehand, a prenup can significantly reduce conflicts and disputes in the future, particularly in the unfortunate event of a divorce.

What Can and Cannot be Included in Prenups

According to the UPAA, a prenuptial contract may address many different rights and matters regarding marital property. These matters include the rights to buy, sell, or otherwise use a piece of property; the division of property upon divorce or death; the making of a will or trust; ownership rights to death benefits from life insurance policies; and which laws will govern the creation of the prenup. The courts will not enforce illegal terms in a prenuptial agreement.

What are 5 things that can be included in a prenup?

- Marital and Separate Property Classification: Clearly define what constitutes marital (shared) and separate (individual) property to avoid default state laws on property division upon divorce. This can include assets like small businesses or income designated as separate property.

- Debt Protection: Specify that any debt incurred by one party during the marriage will not become the responsibility of the other, safeguarding one spouse from the other’s financial liabilities.

- Estate Planning Considerations: Use the prenup to outline how assets should be distributed upon one spouse’s death, complementing wills and trusts as part of a comprehensive estate plan.

- Provisions for Children from Previous Marriages: Ensure that certain assets are passed on to children from prior relationships by designating them as separate property, protecting family heirlooms and inheritances.

- Alimony and Spousal Support: Detail the terms of any alimony or spousal support that one party will provide to the other in case of divorce, including the amount and duration.

What are five things that cannot be included in a prenuptial agreement?

- Child custody and support arrangements.

- Any requirement for one spouse to commit illegal acts.

- Terms that are considered unconscionable or unfair at the time of signing.

- Provisions that would penalize a spouse for initiating a divorce.

- Non-financial matters, such as personal behavior or duties.

The courts also will not enforce verbal prenuptial agreements. If someone wishes to enforce the terms of a prenup in California in court, he or she must have a written, signed, and notarized legal document. One spouse cannot promote divorce, enforce unfair rules, make relationship-related requirements, or fail to disclose all assets and debts if he or she wishes to have a valid premarital agreement in California.

Premarital Agreement Amendments

Amendments to the UPAA that apply to California prenuptial agreements made after 2002 state that agreements will be enforced against a spouse only if that spouse:

- Received complete information about the other spouse’s property and finances before signing the agreement

- Had at least 7 days between first receiving the agreement and signing it (to allow enough time to have an attorney review the agreement), and

- Was represented by a separate attorney when signing the agreement, unless the spouse:

- Received full information in writing about the terms and basic effect of the agreement, including any rights and obligations the agreement would nullify, and

- Signed a separate document acknowledging receipt of such information, identifying the person who provided the information, and expressly waiving the right to an attorney.

Even if all of the above requirements are satisfied, if the spouse did not employ an independent attorney, any provision in the agreement affecting rights to future spousal support (alimony) will not be enforceable.

FAQs on California Prenuptial Agreements

How do I convince my fiancé to sign a prenup?

Talking about a prenup with your fiancé can actually be a positive and constructive conversation! It’s all about how and when you bring it up. Aim for a relaxed moment when both of you are feeling connected, and approach it as a team effort for your mutual benefit. Emphasize that it’s about protecting both of your futures and ensuring you’re both on the same page financially. It’s not about distrust but about smart planning and open communication.

Are prenuptial agreements enforceable in California?

Yes, prenuptial agreements are enforceable in California under the Uniform Premarital Agreement Act (UPAA), provided they meet all legal requirements, including being in writing and signed by both parties.

Can I write my own prenup in California?

While you can draft your own prenuptial agreement in California, it’s strongly recommended that each party seeks independent legal counsel to ensure that the agreement is valid and that their interests are adequately protected.

What is the 7-day rule for prenups?

California requires a 7-day waiting period from the time the final prenuptial agreement is presented to the receiving party before it can be signed. This rule is designed to ensure that both parties have sufficient time to review and understand the agreement before committing to it.

Do both parties need a lawyer for a prenup in California?

While not mandatory, it’s highly recommended that both parties obtain independent legal advice before signing a prenuptial agreement. This is to ensure that both individuals fully understand their rights and the contents of the agreement. Not seeking independent legal counsel could potentially challenge the enforceability of the agreement.

How much does a California prenup cost?

The cost of a prenuptial agreement in California can vary widely, typically ranging from $1,000 to $5,000 or more, depending on the complexity of the agreement and the amount of negotiation required.

What invalidates a prenup in California?

A prenup in California may be invalidated for several reasons, including lack of voluntariness, failure to disclose all assets and debts, provisions that are considered unconscionable, or if it contains illegal terms.

How long do prenups last in California?

Prenuptial agreements in California do not have a set expiration date and generally last for the duration of the marriage unless the couple decides to amend or revoke the agreement in writing.

Does a prenup need to be notarized in California?

Yes, for a prenuptial agreement to be enforceable in California, it must be in writing, signed by both parties and notarized.

How do I get a prenuptial agreement in California without a lawyer?

While it’s possible to draft a prenuptial agreement without a lawyer, it’s not recommended due to the complex legal requirements. If you choose to proceed without legal representation, ensure the agreement is in writing, fully discloses all assets and debts, and is signed and notarized. However, consulting with a lawyer is strongly advised to ensure the agreement’s validity and enforceability.

What voids a prenup?

Factors like fraud, coercion, inadequate financial disclosure, and provisions that are unconscionable at the time of signing can void a prenup.

Can cheating nullify a prenup?

Typically, infidelity alone does not invalidate a prenuptial agreement unless the agreement specifically includes a clause that addresses infidelity and its consequences on the agreement’s terms.