What to Include in a Prenup: The Ultimate Prenuptial Agreement Checklist

Contents

- What to Include in a Prenup: The Ultimate Prenuptial Agreement Checklist

- 1. Marital Property Vs. Non-Marital Property

- 2. Credit & Debt

- 3. Provisions for Children from Previous Marriages

- 4. Estate Plan

- 5. Family Property

- 6. Alimony Rights

- 7. Financial Obligations During Marriage

- 8. Property Division

- 9. State Laws Governing the Agreement

- 10. Sunset Clause

- Updating Prenuptial Agreement as needed

- FAQs about Prenuptial Agreement Checklist

- What is reasonable to ask for in a prenup?

- What all should be included in a prenup?

- What Cannot be included in a prenuptial agreement?

- What should a man ask for in a prenup?

- Can a prenup include cheating?

- What is the most common prenup?

- What should a woman add to a prenup?

- How many pages should a prenup be?

- What’s a fair prenup?

- Should I be offended my fiance wants a prenup?

- Should I be offended if my boyfriend wants a prenup?

- What happens if your wife signs a prenup?

- Should average people get a prenup?

- Does a prenup cover future inheritance?

- Consulting with a Family Attorney

When properly negotiated a prenuptial agreement can protect various finances and assets that each spouse acquired before marriage, including real estate, and educational and/or retirement funds.

A prenuptial agreement can help you and your partner establish boundaries and expectations for financial and property matters and can prevent disputes down the line. The agreement serves as a contract between both spouses that sets forth everyone’s interests in the hopes of reducing any disputes in the event of a divorce. However, how do you know what to include in a prenuptial agreement?

Crafting a prenuptial agreement can be tough but with our ultimate prenuptial agreement checklist, you can ensure that you are covering all of your bases. From determining what assets need to be protected to creating a fair and equitable agreement, this checklist will help you protect your future and make sure that you and your partner are on the same page.

1. Marital Property Vs. Non-Marital Property

Florida is what is known as an equitable distribution state meaning after a divorce, all assets and liabilities will be distributed in an equal manner. To get started, the court will first need to determine which assets are considered marital and which are considered non-marital. While this may appear pretty straightforward, it is rarely that easy to distinguish these two types of assets due to co-mingling. Co-mingling happens when two spouses jointly own non-marital property, thus turning it into marital property. Additionally, when an individual adds his/her spouse’s name to a bank account, the money in this account becomes a marital asset.

Marital Property

Marital property, on the other hand, includes assets or debts acquired during the course of the marriage. This can include items such as joint bank accounts, real estate purchased together, or even businesses started during the marriage. It is crucial to accurately identify and define marital property in the prenuptial agreement to establish how these assets or debts will be divided in the event of a divorce.

Non-Marital Property

Separate property typically refers to assets or debts acquired before the marriage, inheritances, gifts, or personal injury settlements. It is important to clearly identify and document these assets or debts as separate property in the prenuptial agreement to ensure they are not subject to division in the event of a divorce.

A prenuptial agreement can clearly define what constitutes marital and non-marital property to avoid any confusion in the event of a divorce. Trying to untangle assets is time-consuming, expensive, and stressful. A prenup can eliminate the need for such complications.

2. Credit & Debt

Without a valid prenuptial agreement, creditors could go after marital property even though only one spouse I the debtor. A prenup can be used to protect the debt-free spouse from taking on the financial liabilities of the other. Additional things to consider include:

- joint credit issues, as well as using your home as collateral on business; or using a home equity line of credit to fund a business

- if you and your spouse plan on signing new credit obligations together

- Are any back taxes still owed? If there are, how will they be paid?

Debts should not be overlooked when determining what to include in the agreement. Student loans, credit card debts, mortgages, and any other liabilities should be clearly outlined to ensure that each party understands their responsibilities in the event of a separation.

3. Provisions for Children from Previous Marriages

A prenup can be put in place to ensure your children from a previous marriage can still inherit the property and assets you would like reserved for them in the event of a divorce. In a prenuptial agreement, one or both spouses can give up the right to claim a share of the other’s property at death. In addition, it’s helpful to review your estate plan to ensure that it parallels the wishes of your prenup.

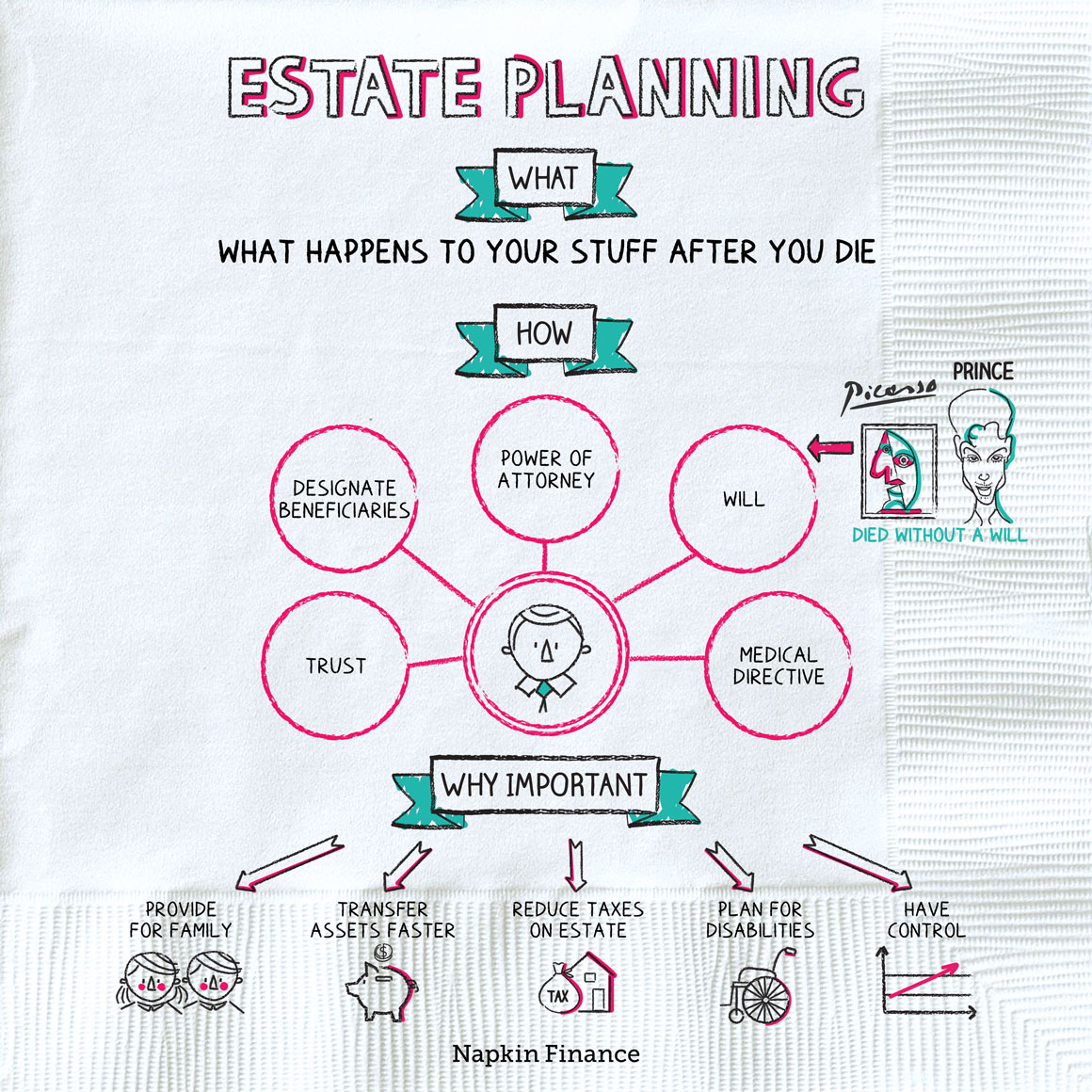

4. Estate Plan

With a valid prenup, you can ensure your estate plan will be carried out according to your wishes. It is important to note that you will still need to create a will and other estate planning documents to protect your estate. Questions to be asked while making your estate plan can include:

- Who will be made the beneficiaries of your estate, which include life insurance policies, retirement plans, stock options, etc?

- Would the terms of your prenuptial agreement end upon death?

- Would the terms of your prenuptial agreement end if you become incapacitated?

Gather all relevant documentation pertaining to retirement accounts and investments. This may include statements from 401(k) plans, IRAs, pension accounts, stocks, bonds, and any other investment vehicles. It is crucial to have a clear

5. Family Property

You can protect family property, including real estate holdings, businesses, and heirlooms, reserving them for your children in the event of a divorce. A valid, properly executed prenup will help establish and protect your heirs’ inheritance rights. Questions to ask yourself include:

- Would a gift from a family member be marital or separate property?

- If you took out a loan from a family member, who is responsible for paying it back?

Gather relevant financial documents such as bank statements, tax returns, property deeds, and investment statements to provide a comprehensive overview of your financial standing. It is also important to discuss any financial goals or plans you have for the future, such as saving for retirement, purchasing a home, or starting a business.

6. Alimony Rights

In the event the higher-earning spouse would like to waive the lower-earning spouse’s right to alimony and create other spousal support provisions, a prenup can be put in place. If you want to keep alimony options open, you can still modify certain aspects. Questions to ask yourself include:

- Will there be any limitations on the duration and amount?

- What are the expectations that both spouses will work?

Another important consideration is whether the spousal support will be modifiable or non-modifiable. Modifiable support allows for adjustments based on changing circumstances, while non-modifiable support remains fixed regardless of changes in income or financial situation.

7. Financial Obligations During Marriage

A prenup can be established to specify certain financial obligations in a marriage. This might include but is not limited to the following:

- Who is responsible for paying the bills

- How much each spouse will contribute to the household

- How major financial decisions will be distributed and decided

Gather relevant financial documents such as bank statements, tax returns, property deeds, and investment statements to provide a comprehensive overview of your financial standing. It is also important to discuss any financial goals or plans you have for the future, such as saving for retirement, purchasing a home, or starting a business.

8. Property Division

Although each state has its own laws pertaining to the distribution of assets and property during a divorce, a prenup can bypass many of them if the couple defines their wishes beforehand. The state of Florida recognizes equitable distribution meaning it will only divide marital property based on what the court feels is fair. Questions to ask yourself include:

- How will marital and separate property be defined?

- Who will get the home if a divorce is filed?

- Who will get the family pets?

While physical assets such as real estate, vehicles, and valuable possessions should certainly be included, consider intangible assets such as intellectual property, business interests, and royalties. These assets can hold significant value and should be protected as well.

9. State Laws Governing the Agreement

A prenup should specify which state has jurisdiction over the agreement as often couples live in a different state than the state the couple was married.

Consult with a qualified family law attorney who is familiar with the laws in your area. They can provide you with accurate and up-to-date information regarding the enforceability of prenuptial agreements in your jurisdiction. Some jurisdictions may have specific requirements or limitations when it comes to prenuptial agreements. For example, certain provisions may be deemed unenforceable, such as those related to child custody or support.

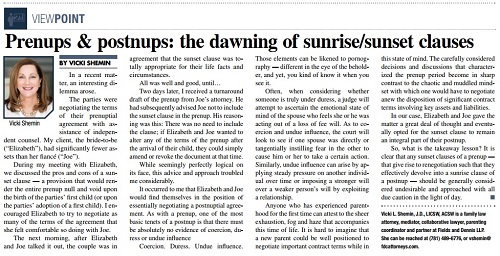

10. Sunset Clause

A sunset clause is a provision within a prenuptial agreement that specifies an expiry date for the contract. It helps ensure that the terms of the agreement are updated or reconsidered at regular intervals, making sure the agreement still serves its purpose and reflects any changes in the parties’ relationship over time.

A sunset clause dictates the end of a prenup after a certain number of years of marriage. For instance, a couple could decide that after 10 years of marriage, the prenup will expire.

What is an example of a sunset clause?

A typical example of a sunset clause might specify that the parties agree to review the contract every five years so as to update it to reflect their current circumstances. Alternatively, a sunset clause could specify that the prenuptial agreement will expire after a certain number of years (such as 10).

What is the 7-day rule for prenups?

The seven-day rule states that both parties to the prenuptial agreement must sign the document at least seven days before the wedding takes place. This allows sufficient time for both parties to properly review the contents of the prenup and seek legal advice if they choose to do so.

Do all prenups dissolve after 10 years?

Not necessarily. The terms and conditions of each prenuptial agreement may vary depending on the wishes of the parties involved. Some agreements may contain a sunset clause specifying that the agreement is only valid for a limited period of time (such as 10 years); however, some agreements may not contain such a clause and thus remain in effect until one or both parties choose to terminate it.

Updating Prenuptial Agreement as needed

A prenuptial agreement is not a one-time document that is set in stone. It is crucial to regularly review and update the agreement as needed throughout the course of your marriage. Life is constantly changing, and so too are your financial circumstances and priorities.

Regularly revisiting your prenuptial agreement ensures that it remains relevant and reflects the current state of your relationship. It is recommended to review the agreement at least every few years, or whenever a major life event occurs, such as the birth of a child, a career change, or a significant increase in assets.

During the review process, both partners should openly communicate and express any concerns or changes they wish to make. This allows for a fair and transparent discussion about the agreement, ensuring that both parties feel heard and understood.

Updating the prenuptial agreement may involve making modifications or amendments to certain provisions. This can include addressing new financial assets, changes in property ownership, or adjustments to spousal support arrangements. It is important to consult with a legal professional during this process to ensure that any changes comply with current laws and regulations.

FAQs about Prenuptial Agreement Checklist

What is reasonable to ask for in a prenup?

When negotiating a prenuptial agreement, both parties should strive for an arrangement that is fair and equitable. Reasonable requests can include separate ownership of preexisting assets, individual liability for existing debt, and detailed provisions outlining the division of marital assets in the event of divorce or death.

What all should be included in a prenup?

Every prenup should outline the rights and responsibilities of both parties during the marriage and upon its dissolution. Detailed provisions should address issues such as financial support, child support, property division, inheritance distributions, and other estate-related matters. Additionally, a prenuptial agreement should provide for written amendments and modifications as needed.

What Cannot be included in a prenuptial agreement?

Generally speaking, any provision that is deemed to be unreasonable or unconscionable will not be enforced by the court. This includes requests such as extreme lifestyle changes or stipulations that would violate public policy. It is important to note that agreements regarding spousal support, child custody, and visitation cannot be validly included in a prenup.

What should a man ask for in a prenup?

Men may request separate ownership of existing assets, protection from the other party’s potential liabilities, spousal support waiver, and tailored provisions addressing inheritance distributions. A man may also seek protection from his partner’s future debts, clarify their respective right to future earnings, and secure specific rights of possession over certain specified assets.

Can a prenup include cheating?

No – courts generally do not enforce clauses concerning infidelity due to strong public policy concerns.

What is the most common prenup?

The most commonly requested provisions in a prenuptial agreement are those relating to asset and liability division, spousal support waivers, inheritance distribution rights, and estate planning measures. Ultimately, each couple should tailor their agreement to their individual needs and circumstances.

What should a woman add to a prenup?

A prenuptial agreement should include an accurate accounting of each spouse’s financial assets and liabilities, a clear understanding of how marital property will be divided in the event of a divorce or death, and any other stipulations that are important for either party to protect. Women may also wish to include provisions concerning maintenance payments after divorce, as well as protection for their personal property, assets, and inheritance rights.

How many pages should a prenup be?

The length of a prenuptial agreement depends on the complexity of the marital situation and the amount of detail needed to clearly define each party’s expectations. In general, prenups should accurately reflect what is agreed upon by both parties and may vary from a couple of pages long to more than 10 pages.

What’s a fair prenup?

A fair prenup is one that creates a fair and equitable environment for both parties, without taking advantage of either individual. A fair prenuptial agreement takes into account both parties’ desires and goals while creating a balanced outcome that will ensure each person’s rights are adequately protected in the event of separation or death.

Should I be offended my fiance wants a prenup?

No. Though it can feel uncomfortable to discuss such a serious topic with your future spouse, a prenup is ultimately intended to protect both parties in the case of divorce or death. Having an open dialogue about finances, expectations, and needs prior to getting married is important in making sure both parties are adequately prepared for what lies ahead.

Should I be offended if my boyfriend wants a prenup?

No. Having a candid conversation about finances and expectations prior to marriage is important for protecting both parties later on down the line. It’s important to remember that a prenuptial agreement does not assume a divorce will occur – rather, it’s meant to provide clarity on how certain situations will be handled should the worst happen.

What happens if your wife signs a prenup?

The prenup then becomes legally binding once it is signed by your wife. That means if your marriage were to come to an end, the courts would most likely enforce the clauses found in the document during the divorce proceedings.

How do you know if a prenup is fair?

A prenup is considered fair when both parties have had full disclosure of all assets and liabilities, each has had ample time to seek the advice of legal counsel, and any language used is clear and unambiguous. Additionally, a fair prenup should include adequate protections for both spouses in the event of divorce or death.

Should average people get a prenup?

Prenuptial agreements can provide couples with financial security in the event their marriage comes to an end. Therefore, even those who don’t consider themselves wealthy may benefit from having a prenup drafted in order to provide clarity on how financial matters will be settled should the marriage dissolve.

Does a prenup cover future inheritance?

Yes, a prenuptial agreement can address future inheritances. If either party wishes to leave certain possessions or funds solely to his/her descendants, this can be detailed in the prenup accordingly so as to ensure those items are not subject to division by family law upon divorce.

Consulting with a Family Attorney

Protecting your future with a comprehensive prenuptial agreement is a wise decision that can provide peace of mind and financial security for both parties involved. By following this ultimate prenuptial agreement checklist, you can address important considerations such as asset protection, debt allocation, spousal support, and even provisions for the care and custody of children.

While it may be tempting to rely on online templates or advice from friends, this is one area where professional guidance is crucial. An attorney specializing in family law and prenuptial agreements will have the expertise and knowledge to ensure that your agreement is legally sound and provides the necessary protection for your future.

We hope you found our ultimate prenuptial agreement checklist helpful in protecting your future. A prenuptial agreement can be a sensitive topic, but it is an essential tool for safeguarding your assets and ensuring financial security in the event of a divorce. By following the comprehensive checklist provided in this blog post, you can ensure that your prenuptial agreement covers all the necessary aspects and provides the protection you need. Remember, open communication and transparency are key when discussing this important legal document with your partner. Wishing you a happy and secure future together!