Tenant Rights in Foreclosed Property

Contents

- Tenant Rights in Foreclosed Property

- Landlord is Not Paying the Mortgage

- Understanding Tenant Rights

- Communicating with your Landlord

- Protecting your security deposit and belongings

- Seeking Legal Advice

- FAQs about Tenant Rights in a Foreclosure

- How long can a tenant stay in a foreclosed property in Illinois?

- How long can a tenant stay in a foreclosed property in Pennsylvania?

- How do you evict someone after foreclosure in Texas?

- How long do you have to move out after foreclosure in Texas?

- What is a notice to vacate after foreclosure?

- How long does a foreclosure take in Texas?

- How long can you default on a mortgage before foreclosure?

- Final Word

Navigating rental laws and your tenant rights can be a challenge when your landlord is in default. Unfortunately, too often renters are unaware that their property owner is behind on payments until it’s too late. However, the federal Protecting Tenants at Foreclosure Act has provided tenants with safeguards to ensure that they are not left without recourse when faced with the potential of losing their homes.

In this post, we will provide you with a clear understanding of foreclosure, its implications for renters, and what you can do to protect yourself during this complicated process. We will cover critical topics such as how to recognize signs of foreclosure, how to communicate with your landlord, what happens to your lease agreement, and what legal options are available to you. So, if you’re a renter who is worried about what to do if your landlord falls behind on their payments, keep reading for some valuable insights.

Landlord is Not Paying the Mortgage

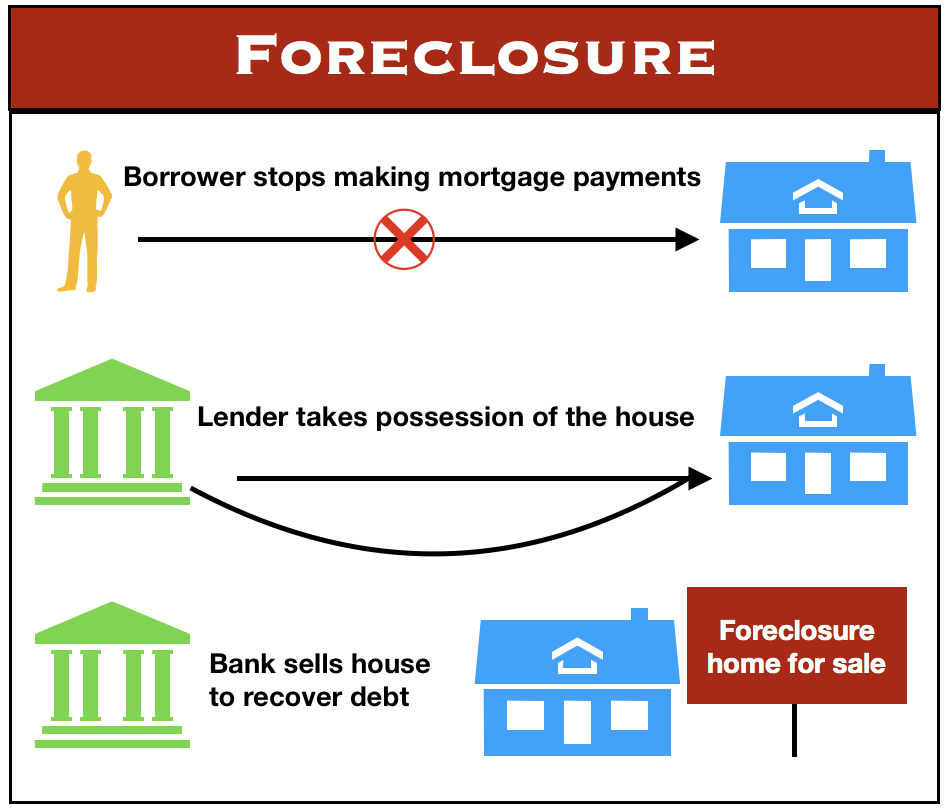

It can become apparent to renters when their landlord is not paying their mortgage if rising costs, late or no rent payments, and other signs point to this issue. Should the situation reach foreclosure, landlords typically will not continue renting out the property and instead, try to force eviction.

Financial institutions will then attempt to sell the property while offering small settlements which may be beneficial to those under protected or rent-controlled agreements. On the rare occasion, they may hire a new property manager to take over and collect rent but this is unlikely as banking institutions replace non-performing assets from their books by selling them.

Signs of Impending Foreclosure

Recognizing the signs of impending foreclosure is crucial for renters who want to stay informed and prepared. While it may not always be evident at first glance, there are certain red flags that can indicate a property is at risk of foreclosure. By being vigilant and observant, renters can take necessary precautions to protect their rights and ensure their housing stability.

One of the first signs to watch out for is a sudden change in property management or ownership. If there is a frequent turnover of landlords or property managers, it could be a warning sign that the property is facing financial difficulties. If maintenance and repairs start to decline significantly, it could indicate a lack of funds to properly maintain the property, which may be a result of impending foreclosure.

Another sign to look out for is an increase in vacant units or unoccupied properties within the same building or complex. If neighboring units are consistently vacant or there is a sudden spike in unoccupied properties, it could be an indication that the property owner is struggling financially and unable to fill the vacancies.

If you receive notices addressed to the property owner regarding late payments or foreclosure proceedings, it is a clear indication that the property is at risk. While renters may not always receive direct communication from lenders, being aware of any related correspondence can help them understand the situation better and take necessary actions to protect themselves.

Keeping an eye on local news and financial trends can provide valuable insights into the economic stability of the area. If there are reports of economic downturns, rising foreclosure rates, or financial troubles in the real estate market, it is a good idea for renters to be extra cautious and proactive in monitoring their rental situation.

Leases End on Foreclosure

The majority of rental agreements will end when the property goes into foreclosure as they are mutually established after the mortgage. In most cases, real estate law grants renters extended periods of time to find a new home so it’s important to never take chances with eviction notices or beyond the allotted timeframe as an eviction record can make it difficult to find new housing.

Understanding Tenant Rights

With the Protecting Tenants at Foreclosure Act, you are guaranteed a minimum of 90 days to vacate should you be living in a property being taken over by another owner. This applies to all tenant types, whether on a month-to-month lease or expired agreement and regardless of what use the new owner intends for the property, as long as you have tenancy rights.

The Helping Families Save Their Homes Act of 2009, P.L. 111-22, was signed into law on May 20, 2009. Title VII of this law, the Protecting Tenants at Foreclosure Act, ensures that tenants facing eviction as a result of foreclosure on the properties they are renting have adequate time to find alternative housing. This law establishes a minimum time period a tenant can remain in a foreclosed property before eviction. – S.896 – Helping Families Save Their Homes Act of 2009

Understandably, it can be a difficult situation where you have little control over your current housing status but knowing and understanding your rights can help you remain secure in your home as much as possible.

Communicating with your Landlord

During the foreclosure process, it is crucial for renters to maintain open lines of communication with their landlords. Facing foreclosure can be a stressful and uncertain time, but keeping the lines of communication open can help renters understand their rights and options.

By communicating with your landlord, you can gain a better understanding of the timeline and potential outcomes of the foreclosure process. Inquire about any specific notices or legal documents you may receive, and discuss how their lease agreement will be affected.

Reach out to your landlord as soon as they become aware of the foreclosure proceedings. It is important to initiate a conversation about the situation, expressing concerns and seeking clarification on how it may impact their tenancy.

- Renters should also express their willingness to continue paying rent on time, as this demonstrates their commitment to fulfilling their obligations. Openly discussing their financial situation and any potential challenges they may face can help establish trust and foster a cooperative relationship with the landlord.

- Renters should inquire about their rights and protections during the foreclosure process. Depending on local laws and regulations, there may be specific provisions in place to safeguard renters’ interests. It is important to ask about any applicable tenant protection laws and understand how they may be enforced.

- Renters should keep a record of all communication with their landlords. This includes written correspondence, emails, and phone conversations. Documenting these interactions can serve as evidence if any disputes or misunderstandings arise in the future.

Protecting your security deposit and belongings

Review your lease agreement to understand the specific terms regarding security deposits. In most cases, landlords are required to return the security deposit within a certain timeframe, typically 30 days, after the termination of the lease. However, in the event of foreclosure, the situation becomes more complex.

If the property is foreclosed upon, the new owner or bank may assume responsibility for returning the security deposit. Renters should proactively reach out to the new owner or bank to inquire about the status of their deposit and ensure its safe return. It is advisable to document all communication and keep copies of any correspondence related to the security deposit.

Consider obtaining renter’s insurance if you do not already have it. Renter’s insurance provides coverage for your personal belongings in case of theft, damage, or other unforeseen circumstances. This additional layer of protection can provide peace of mind during uncertain times.

In addition to the security deposit, take steps to protect their personal belongings. Create a detailed inventory of all possessions, including photographs or videos of valuable items. This inventory will serve as evidence of ownership and can be helpful in the event of loss, damage, or disputes.

Seeking Legal Advice

Consulting with a qualified attorney who specializes in real estate law can provide valuable guidance and ensure that you are informed about the legal implications and potential remedies available to you.

A knowledgeable attorney can help review your lease agreement and assess whether the foreclosure process should impact your tenancy rights. They can explain the local laws and regulations governing foreclosures and provide insights on how they may apply to your specific situation. Understanding the legalities involved can help you make informed decisions and protect your interests.

An attorney can:

- communicate with the landlord or the foreclosing party

- represent your interests

- negotiate potential solutions

They can help explore alternatives, such as negotiating a lease extension, arranging a lease transfer, or seeking financial assistance programs designed to aid tenants in foreclosure situations.

Having a legal advocate by your side can provide peace of mind during this stressful period. They can help ensure that your rights are protected, provide advice on potential legal actions you may take, and guide you through any necessary legal processes.

FAQs about Tenant Rights in a Foreclosure

How long can a tenant stay in a foreclosed property in Illinois?

In the state of Illinois, tenants are afforded certain protections under the law during foreclosure proceedings. In general, a tenant may remain in their rental unit until the end of their lease agreement or until the new owner has given them proper notice to vacate, typically at least 90 days’ notice.

How long can a tenant stay in a foreclosed property in Pennsylvania?

Under Pennsylvania law, tenants are protected from eviction during the foreclosure process and, if their lease remains in effect, until the end of its term. Depending on the situation, they may even be able to remain in the property beyond the end of their lease if the new owner is willing to enter into a new tenancy agreement. They must receive at least 90 days’ notice of eviction.

How do you evict someone after foreclosure in Texas?

In Texas, evictions after foreclosure should follow standard eviction procedures. The new owner must provide written notice to vacate, which affords the tenant time to move out before filing an eviction suit with the court. It’s important to note that specific steps may vary depending on local ordinances in your area.

How long do you have to move out after foreclosure in Texas?

After receiving notice to vacate from the new owner, tenants generally have 5 days to move out of the property. This timeline may vary depending on local ordinances and other factors, so it’s important to read any notices carefully and check with your local authorities for more information.

What is a notice to vacate after foreclosure?

A notice to vacate after foreclosure is a written document served by the new property owner to inform current tenants that they must vacate the premises within a certain period of time (usually 3 days). This notice should include relevant information about the property, including the date when tenants must leave and any necessary contact information.

How long does a foreclosure take in Texas?

The length of time it takes to complete a foreclosure in Texas will vary based on several factors, such as whether the case goes through traditional litigation or nonjudicial foreclosure. Generally speaking, foreclosures can take about six months.

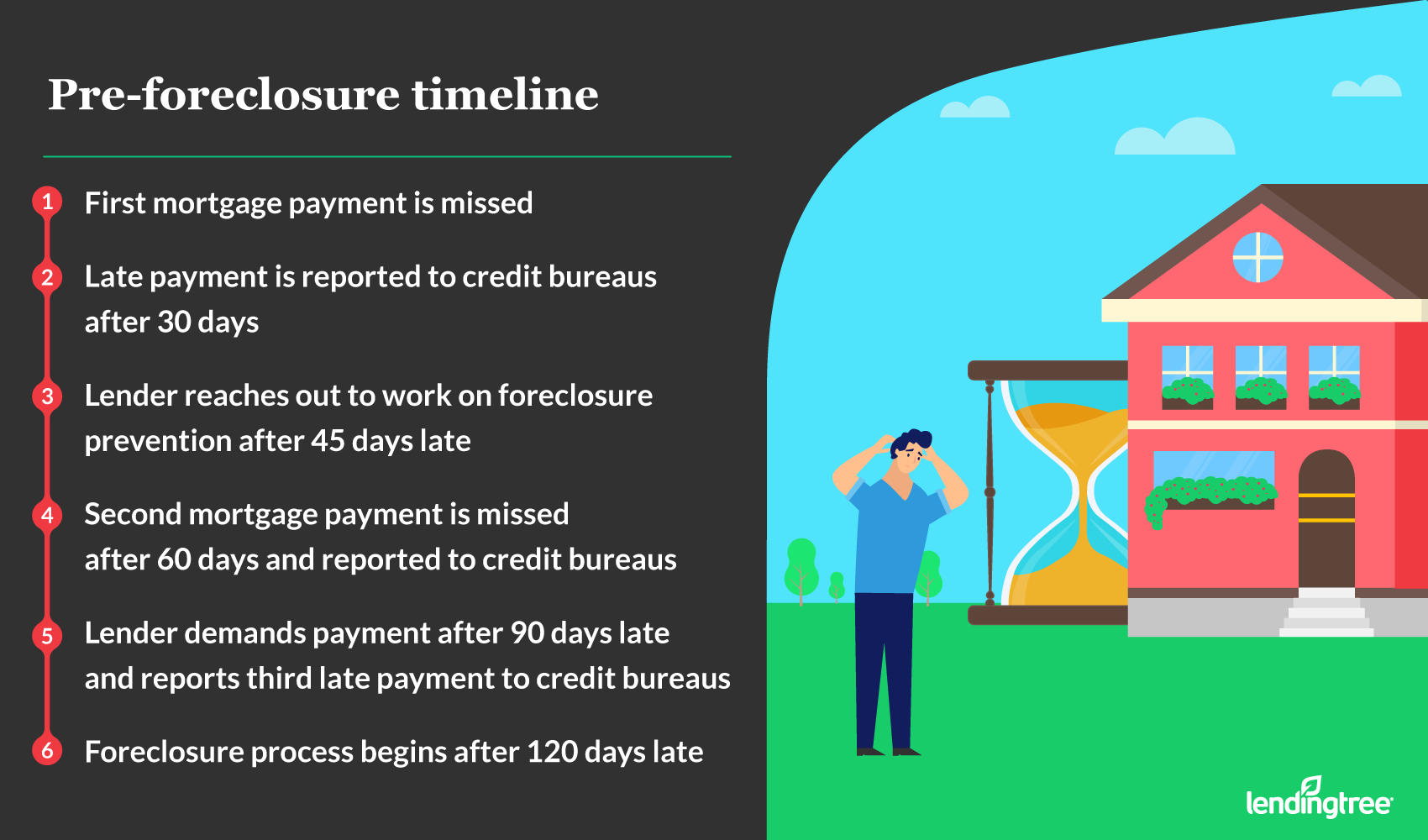

How long can you default on a mortgage before foreclosure?

The amount of time you can default on your mortgage payments before facing foreclosure varies from lender to lender and state to state. Typically, borrowers must be in default for at least 4 consecutive months (120 days) before a lender begins the foreclosure process. If you’re having trouble making your mortgage payments, contact your lender as soon as possible to discuss potential solutions.

Final Word

We hope you found our blog post on navigating foreclosure as a renter informative and helpful. Facing foreclosure can be a stressful and uncertain situation, especially for renters who may not have been aware of their landlord’s financial difficulties.

By understanding your rights and taking proactive steps, such as monitoring foreclosure filings and staying in communication with the lender, you can protect yourself and minimize the disruption to your living situation. Remember, you are not alone, and there are resources available to assist you during this challenging time. Stay informed, stay proactive, and take control of your situation.