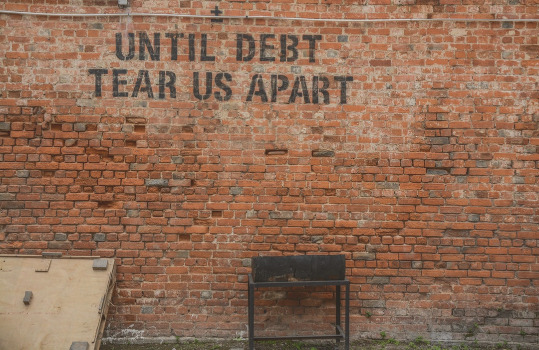

Most people understand the importance of good credit in starting a new, independent life after a divorce. Unfortunately, many people find that their credit is damaged due to circumstances that occurred during the marriage. In addition to repairing damaged credit and building good credit (topics for future articles), cleaning up your accounts is a place to start.

How to Protect Your Credit During Divorce

If you are in the throes of divorce, it’s important to protect your credit. Your finances can take a real hit during divorce, and women usually suffer more than men, writes Katherine McKee for FirstWivesWorld.com (read our previous post for a review of the website). “Without a solid credit history in your own name, you won’t be able to qualify for re-financing the marital home. And you’re also likely to end up with high-interest credit cards and auto loans,” she warns.

Follow these tips to protect your credit rating during and after divorce:

- Pay off joint debts. Until they’re paid, you’re both responsible. If they can’t be paid, freeze the account so neither of you can increase the debt.

- Get a credit card in your own name, then cancel joint credit cards. Make sure you remove your name as a user on your spouse’s cards to prevent their credit issues from also being reported under your name.

- Pay off car loans and retitle each vehicle in only one name.

- If you have trouble paying monthly bills due to illness or job loss, talk to your creditors and work out a payment arrangement. The unpaid debt will be reported and can lower your credit score.

As part of the divorce, you should be proactive in removing your spouse from your credit report. This “clean-up” can take many possible forms.

Inactive Accounts

You may see that there are accounts that were opened during (or before) your marriage that you no longer need. It is a good idea to keep your open lines of credit to a small number. Closing those inactive accounts reduces your chance of someone fraudulently using your credit and increases your score. Conversely, having too few lines of credit open to you can lead to an adverse score. Leave at least 1 or 2 accounts open with a zero balance.

Joint Accounts

For joint accounts with your ex-spouse, you will want to simply close those accounts. When you attempt to remove an owner you usually have to re-apply in your own name anyway, and receive a new individual account number. If the account balance is zero, simply send a letter requesting that the account be closed. If the balance is not zero, move the balance to another card first.

Accounts that you own alone may have your ex-spouse listed as an authorized user. This exposes you to possible liability from charges he/she may make after your divorce. For each account you wish to keep open that has an ex-spouse listed as an authorized user, send a letter requesting that (s) be removed as an authorized user.

Your credit report will also show accounts on which you are an authorized user, even if you are not an owner. You do not want to be an authorized user on your ex-spouse’s accounts, for liability reasons. Send a letter requesting that you be removed as an authorized user.

Once you’ve made these requests, give 45 – 60 days for lenders to complete your requests and report the new statuses to the credit agencies. Then check your credit report again. It may be inconvenient to follow up, but it’s important to protect your credit rating, especially during or after a divorce.

I can relate to the importance of cleaning up accounts and repairing credit after a divorce. A close friend of mine went through a difficult divorce a few years ago, and her credit was severely impacted as a result.

During the marriage, her ex-husband had taken out several loans and credit cards in both of their names without her knowledge. He accumulated a significant amount of debt, which he failed to repay, leaving my friend responsible for the financial mess.

After the divorce, my friend was determined to rebuild her credit and regain control of her financial situation. She started by thoroughly reviewing her credit reports to identify all the accounts that were opened without her consent. She then contacted each creditor to explain the situation and request that her name be removed from the accounts.

While some creditors were understanding and cooperative, others were less willing to help. My friend had to provide evidence and documentation to prove that she was not responsible for the debt incurred during the marriage. It was a time-consuming and emotionally draining process, but she persisted.

She also sought the assistance of a credit counseling agency to help her negotiate with creditors and create a repayment plan for the debts that she was genuinely responsible for. The agency provided her with valuable guidance on managing her finances, budgeting, and improving her credit score.

Over time, my friend was able to clean up her credit accounts, remove her name from the fraudulent ones, and gradually rebuild her credit. She made consistent payments on her remaining debts and practiced responsible financial habits. It wasn’t easy, but her determination paid off.

Today, my friend has successfully repaired her credit and is in a much better financial position. She has learned valuable lessons about the importance of monitoring her credit, being proactive in addressing fraudulent accounts, and taking control of her

I can definitely relate to the importance of cleaning up accounts after a divorce. When my parents got divorced, my mom was left with a lot of joint accounts that needed to be addressed. It was a messy situation because my dad had accumulated a lot of debt during their marriage, and my mom was worried about how it would affect her credit.

One of the first things my mom did was to close any joint accounts that she could. This included credit cards, bank accounts, and even utility accounts. It was a tedious process because she had to contact each company individually and provide them with the necessary documentation to remove her name from the accounts.

Next, my mom focused on paying off any outstanding debts that were in her name. She wanted to start fresh and not have any lingering financial burdens from the marriage. It took a lot of budgeting and sacrifice, but she was determined to get her finances in order.

She also made sure to monitor her credit report regularly to ensure that there were no surprises or unauthorized